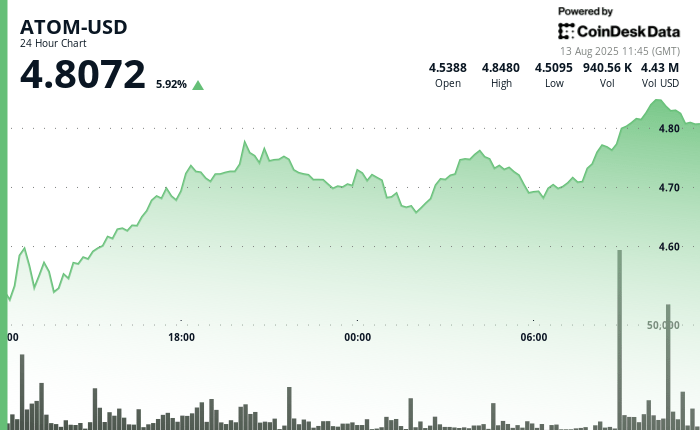

Atom experienced an increase of $ 4.49 to $ 4.49 between August 12, August 12 and 1:00 p.m., supported by a heavy trading volume of more than 2 million units, reporting a strong institutional interest. The bullish momentum persisted in the last hour of negotiation, culminating at $ 4.85 before consolidating itself at $ 4.83, with a large volume confirmation reinforcing the rupture above the resistance of $ 4.78. Solid support was established at $ 4.65, preparing the field for a possible movement towards the range of $ 4.90 at $ 5.00.

During the last hour, the atom went from $ 4.82 to $ 4.85 – a gain of 0.62%, before relieving slightly to $ 4.83, a drop of 0.21% of the high session. In particular, the level of $ 4.85 was tested and validated by a volume peak of 24,467 units at 10:20, followed by a profit taking which led to a measured decline. Subsequent volume peaks of 47,638 units at 10:44 am and 59,892 units at 10:48 am during recovery attempts underlined the continuous institutional commitment, even in the consolidation phases.

The closing minutes have seen a minimum activity, indicating a brief break in the negotiation momentum. However, the combination of sustained purchase interest, the increase in support levels and decisive resistance violations suggests that the atom is well positioned for the workforce. With the dynamics of the volume confirming the upward intention, the asset remains on the right track for a potential price of the price target of 4.90 to 5.00 short -term.

This decision comes as the domination of Bitcoin has dropped below 60% for the first time since January, demonstrating a relative force in the Altcoin sector. However, if Bitcoin can exceed $ 124,000 and form a new high record, altcoins can slip while Capital turns to BTC.

Key technical indicators

- Atom presented a convincing upward trajectory with a global range of $ 0.38 (8.52%) Throughout the 23 -hour negotiation period.

- Robust support established at $ 4.65 with substantial volume confirmation during the 02h00 recovery phase.

- The resistance materialized at $ 4.78 where the price action initially encountered resistance at 8:00 p.m. before reaching the breakthrough up.

- The acceleration of notable momentum occurred during the end hours, in particular at 9:00 am, an exceptional volume considerably exceeding the average of 24 hours of 1,148,473 units.

- Technical breakout supported by sustained expansion of volume and ascending support training.

- Successful examination of a resistance zone of $ 4.85 with a robust volume confirmation preceding for profit.

- The volume increases at critical inflection points confirming institutional participation within the consolidation phase.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.