Pepper

The same on the theme of frogs which increased in popularity earlier this year, fell by around 4% in the last 24 hours. The decline occurred while commercial activity through the Easter tokens sector has cooled by the tops seen earlier this week.

The wider market of the same, based on the Coindesk Memecoin index (CDMEME) experienced a 3% drop in the last 24-hour period, considerably underperforming the larger market. Measured via the Coindesk 20 index (CD20), the wider market has lost only 0.1% of its value during the period.

The accumulation of whales has nevertheless been in progress, the 100 best PEPE addresses on the Ethereum network, seeing their participations increase by 1.5% in the last 30 days, while PEPE on trade has dropped by 0.5% over the same period according to Nansen data.

Preview of technical analysis

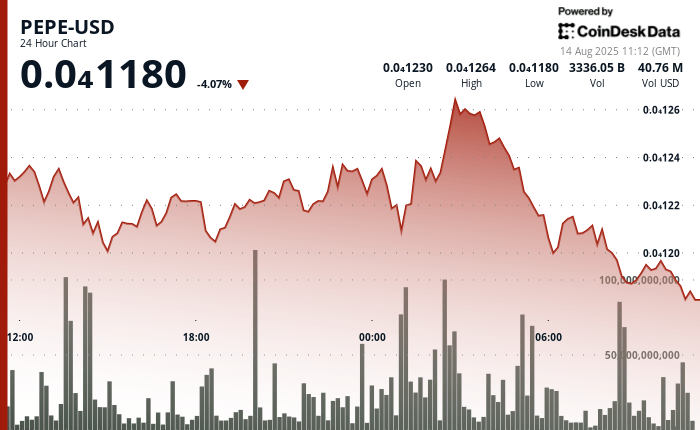

The PEPE exchanged in a range of $ 0.0000081 in the last 24 hours, marking a spread of 7% between the Technical Analysis Data model of Coindesk Research.

The peak amounted to 0.0000126621, but attempts to rupture repeated above $ 0.000012 have a sale pressure. The critical intraday support was tested around 0.000000118094. The token then entered a tight consolidation channel between 0.00001181 and $ 0.00001198, signaling indecision among traders.

The day ended with PEPE depositing at 0.000000118, slightly above the support but under a clear distribution pressure of the sellers. Unless its price can recover and maintain above the resistance zone of $ 0.000012, the momentum can promote a retaining of the lower support levels.

The volume models during the session suggest that the buyer’s strength decreases compared to the week earlier in the week, which could limit the chances of a sustained increase without renewed market catalysts.