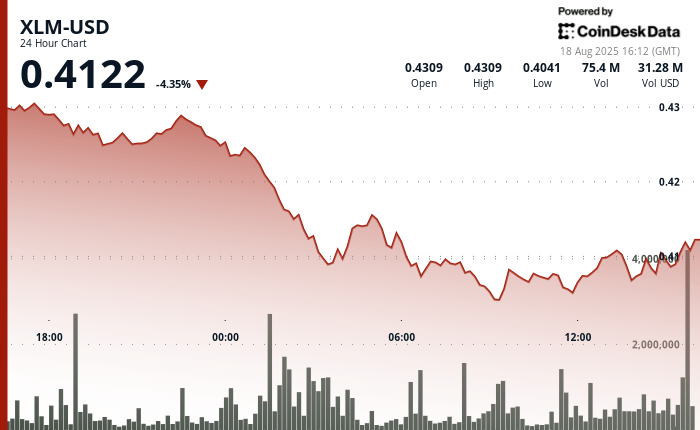

The Stellar XLM token underwent a strong institutional sale pressure between August 17 at 3:00 p.m. and August 18 at 2:00 p.m., from $ 0.43 to $ 0.41 in a drop of 6%.

Negotiation volumes during the period 24 hours a day exceeded $ 30 million, which represents around 7% of daily turnover.

The most notable liquidation event occurred between 1:00 and 3:00 on August 18, when the institutional sellers discharged more than 60 million tokens. This sale forced XLM from $ 0.42 to $ 0.41, creating strong resistance at $ 0.42 and defining a new support almost $ 0.41.

Despite the attempts to recover, the assets did not break the resistance zone, signaling a persistent institutional drop and leaving XLM vulnerable to the decline.

The time of final negotiation of August 18 added a new pressure, because XLM recorded a drop of 1% between 1:2 p.m. and 2:20 p.m. The institutional sale has accelerated between 1:31 p.m. and 1:42 p.m., business liquidations passing prices from $ 0.41 to $ 0.41 over volumes exceeding 2.7 million units.

This wave of activity confirmed the resistance to $ 0.41 and set a short -term support floor at the same level. Multiple recovery attempts throughout the time were welcomed with a renewed sale pressure, culminating in a stagnation of around $ 0.41 with a minimum volume in the last 20 minutes.

The lack of purchase interest highlights the possibility of greater weakness if the sellers take back the momentum.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.