XRP closed Monday session under pressure, reversing an anterior rally and ending near the $ 3.00 threshold. A net sale in the time of final negotiation has seen the asset drop by 1% on the volume of the increase, suggesting institutional distribution and liquidations in Stop-Loss leading the action of prices.

Technical analysis shows mixed signals

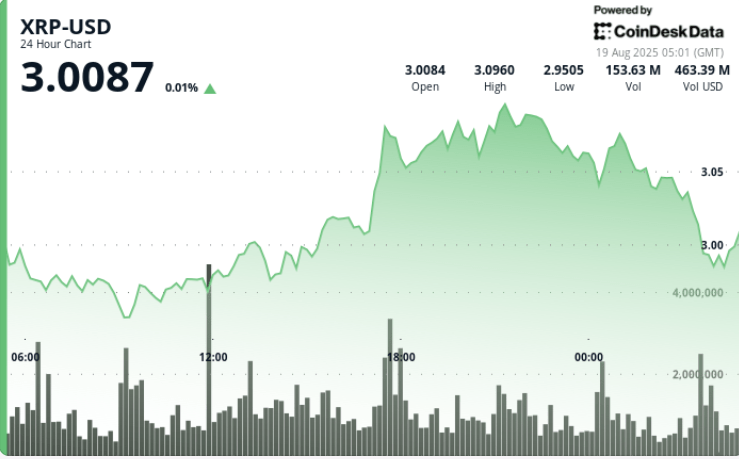

XRP exchanged in a range of $ 0.11 between $ 2.94 and $ 3.10 on the 24 -hour session of August 18 05:00 to August 19 04:00, representing almost 4% of intraday volatility. A bullish escape during the negotiation time of 5:00 p.m. on August 18 brought prices from $ 2.97 to $ 3.10, supported by a heavy volume of 131 million – an average of 24 hours of 66.8 million. This short -term support established nearly $ 3.00.

The momentum is quickly, however. The token has rejected several times to $ 3.09, sliding in consolidation around $ 2.99. An aggressive withdrawal took place during 3:00 am on August 19, when XRP went from $ 3.04 to $ 2.99.

Key market movements

• XRP decreased by 1% in the last 60 minutes, from $ 3.03 to $ 2.99 while volumes increased to 5.26 million – five times the average

• Accelerated distribution pressure around the psychological threshold of $ 3.00, triggering liquidations in stop-loss during the interval 03: 43–03: 46

• An upward wave earlier in the session (August 18, 5:00 p.m.) raised XRP from $ 2.97 to $ 3.10 out of 131 million volumes, an activity much above average

Market dynamics leads to a clear reversal

Ventilation at the end of the session confirmed an institutional sale nearly $ 3.00, erasing the dynamics of the previous escape. While $ 2.99 provided intraday stabilization, the rejection supported by the volume at $ 3.09 highlights the growing pressure of the resistance.

XRP is now at a crossroads: holding more than $ 2.99 could allow bulls to retest the cluster of $ 3.08 to $ 3.09, while failure risks a deeper correction towards the request zone of $ 2.96.

Summary of technical indicators

• range: $ 0.11 (3.8%) between $ 3.10 and $ 2.94

• Resistance: $ 3.09, rejected several times by evening sessions

• Support: $ 3.00 Psychological Nivel, tested under a high volume distribution

• Risk: breakdown to the request zone of $ 2.96 if $ 2.99 fail

• Signal: Structure of Haussier triangle intact, but the momentum fades under the profit