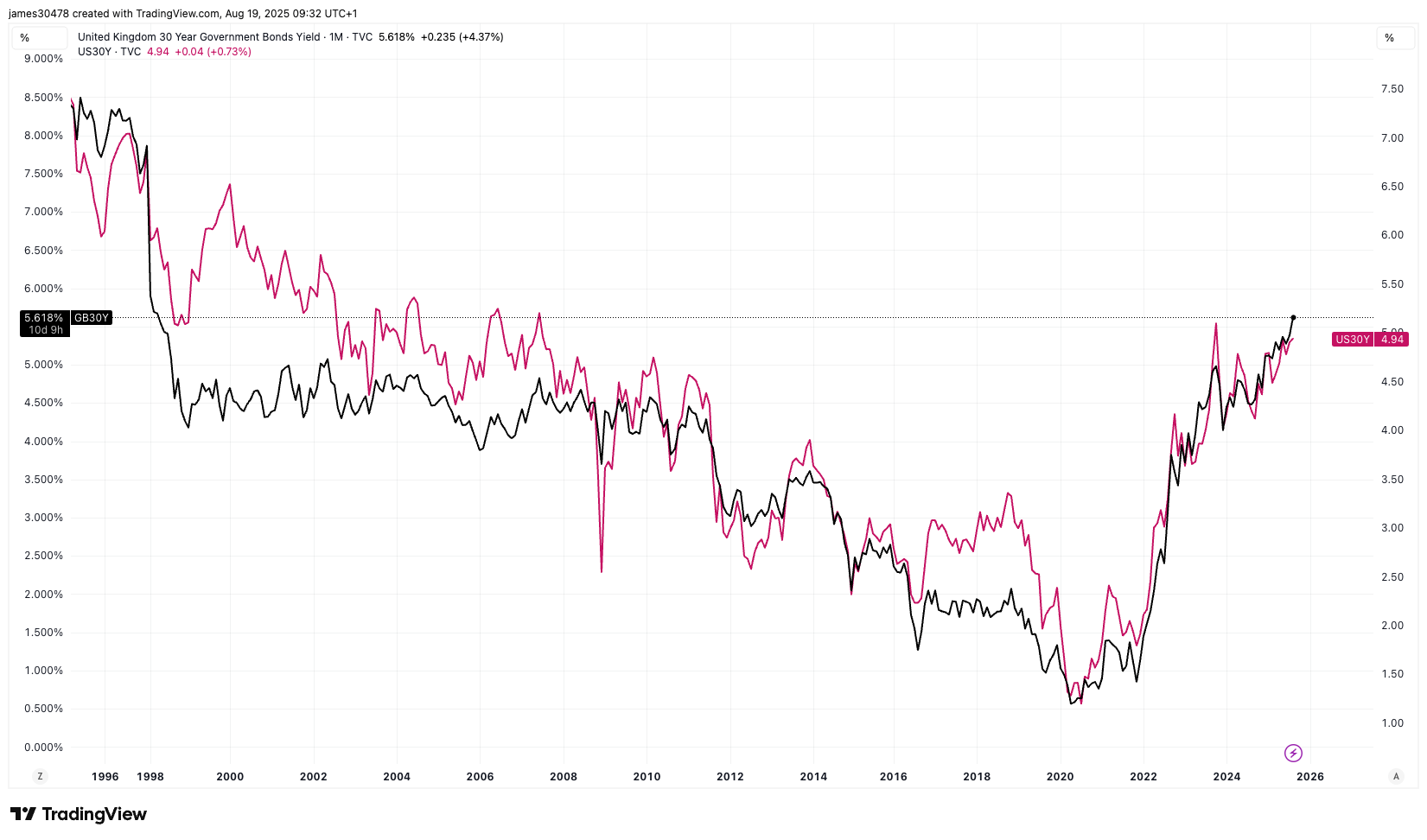

The fragile budgetary situation of the United Kingdom is back forward, because the yields on long-term public obligations have increased, going beyond their American counterparts for the first time this century.

The 30 -year -old British government’s obligation offered a yield of 5.61% at the time of the press. This represents 68 more base points than the 30 -year -old American treasury yield according to the source of tradingView data.

The difference of gap means that the market requires an important premium to maintain debt tickets in the United Kingdom against the Treasury, a sign that investors are becoming more suspicious of the United Kingdom’s budgetary situation.

The British golden market (Bond market) tackled its own life, because the country is faced with long -term structural economic challenges it has formed for decades; However, this is not a unique British question. Japan, the EU and the United States have also seen bond yields increase as debt charges and inflation pressures are rising.

This debt in the advanced world supports the optimistic case of value store assets perceived as bitcoin

and gold.

Focus on the British inflation report

Wednesday’s inflation report in Wednesday is essential for bond markets.

The data should show that the consumer price index on the head (ICC) And the basic ICC remained well above the target of 2% in July, according to the commercial economy of the data source. The CPI title should be 3.7% from one year to the next (up compared to the previous 3.6%)while central inflation should remain at 3.7% (unchanged from the previous month). Data will reach the wires only a few weeks after reducing the rates of the Bank of England to 4%.

The expectations for sticky inflation could not have arrived at a worse moment, because the growth of GDP has weakened and unemployment began to surpass itself from secular stockings.

Repeat from the 2022 crisis?

A hot inflation ratio cannot worsen the dynamics of debt binding by accelerating the upward trend of yields. This calls for crypto and traditional market merchants to remain vigilant for 2022 style volatility on the British markets.

The hardening of golden yield at 30 years, representing the long end of the curve, played an important role in the investment focused on responsibilities (LDI) 2022 retirement crisis, which broke out under Liz Truss. The longer duration yield now tests the upper limit of a long -term trend and could reach 5.7%, the highest level since May 1998.

LDI strategies use the leverage to cover pension liabilities. When the golden yields enriched in 2022, the guarantee calls led to a mass sale of checks, creating a feedback loop which threatened financial stability. This prompted the Bank of England to intervene with emergency purchases to prevent a systemic crisis.

If Wednesday’s inflation report is warmer than expected, golden yields could break new peaks, exerting additional pressure on the government and increasing the risk of another LDI style crisis.