For more than a decade, the mantra for Bitcoin holders has been clear: “Not your keys, not your pieces.” But as Bitcoin matures in a worldly recognized asset, this state of mind is no longer sufficient for whales that managed hundreds of millions in BTC. The recent movement of more than 80,000 BTCs from eight wallets from the Satoshi era – the largest transfer of this type in the history of Bitcoin – has rekindled attention to the way in which heritage holders manage and end up relaxing large positions. Hold the bitcoin to the point directly, in particular in large quantities, exposes investors to a preventable risk, operational headaches and regulatory friction – not to mention the type of nightmare who can keep even the most seasoned holders at night.

Une alternative existe sous la forme de produits réglementés en échange de bitcoins (ETP) – une structure éprouvée de type capital propres avec un historique solide. Crypto ETPs to be physically supported have been available in Europe for over seven years. These products combine transparency and the guarantees of traditional markets with the innovation of digital assets – offering stronger safety frames, access to the improvement of liquidity, tax and compliance and the possibility of using them as a guarantee for loans. For major holders, the case to move to regulated packaging becomes too strong to ignore.

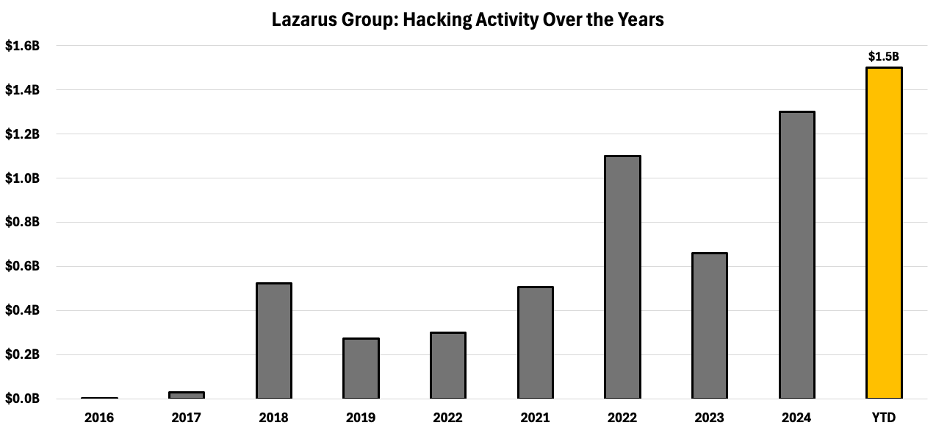

Liquidity is a major concern. Large holders who wish to relax a position are often faced with a significant shift and a counterpart risk on centralized exchanges. Alternatively, they must appoint external companies to manage the process, trigger delays due to integration and KYC and often pay an execution bonus. With an ETP, administrative obstacles are loaded before; Once on board, the investor has access to the liquidity pool of ETP, simplifying and accelerating output strategies when the calendar is important. Many whales believe that the self-toilet maximizes security. In reality, the management of large spots of spots is incredibly complex. Key management, cold storage logistics, succession planning and internal controls require infrastructure than few people – or even crypto -native funds – can maintain on a large scale. The regulated ETPs are fully bypassing it by offering childcare solutions managed by professionals – combining separate accounts, insurance coverage and direct monitoring of financial regulators. European structures go even further with bankruptcy and legal title of the underlying BTC. It is not a question of giving up property, in fact, it is an upgrade of the way in which this property is owned: in complete safety, in a transparent manner and with guarantees of institutional quality to avoid loss and fraud. For example, the Lazare group, one of the most notorious hacking organizations in North Korea, was responsible for a significant number of violations related to the crypto, which led to the flight of $ 1.5 billion this year.

Figure 1: Total value of crypto hacks in USD in recent years

Source: Chain Analysis

European ETPs allow in -nature transfers that allow investors to move Bitcoin directly in and outside the fund without triggering a taxable event. This is particularly precious in courts like Switzerland and Germany, where long -term holders can optimize the treatment of capital gains. For long -term whales, the flexibility of flow in kind is a major upgrade. It also unlocks a new financial option; Rather than selling their bitcoin during a major life event such as the purchase of a house, investors can borrow against their ETP participations and access liquidity without ever separating from the underlying assets and triggering capital gains.

Auto-customer will always have a place, especially for users in unstable regions or those who need financial sovereignty. But for scale whales, compromises to maintain the BTC spot are more and more difficult to justify. The ETP Bitcoin are simply less headache: they reduce risks, improve access to liquidity, simplify compliance and offer long -term infrastructure for serious capital beneficiaries, allowing large investors to sleep easily at night. The future of Bitcoin property does not concern if you can Hold your keys, it’s about knowing if you should.