Ether

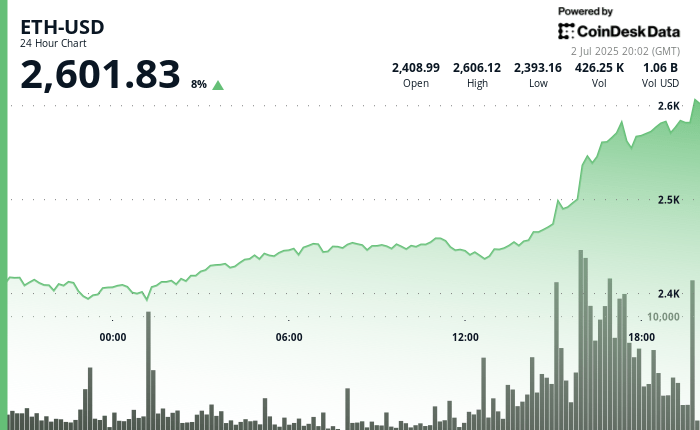

The price increased to $ 2,601 on July 2, causing a break that started after 16 hours of tight consolidation, according to the Technical Analysis model of Coindesk Research.

This decision coincided with the growing accent on the institutional role on the emerging role of Ethereum as a platform for token financial products, as well as on the continuous momentum in ETF entries.

On June 30, Robinhood confirmed via X that he built “Robinhood Chain” on Arbitrum to “fuel the future of asset ownership”. Although the company has not specified a launching calendar, its decision to rely on the main layer 2 Ethereum solution reinforces the network position at the center of token finance. The Ethereum Foundation has amplified this story in a response that was read: “Ethereum is intended for token actions”.

Building on this theme, CIO Bitwise Matt Hougan offered a bullish forecast on July 2. Responding to the position of the Ethereum Foundation, Hougan said: “The flows of ETHEREUM will accelerate considerably in H2. The combination of traditional investors and actions on Ethereum is an easy story to enlarge for traditional investors. “He noted that ETHEREUM had attracted $ 1.17 billion in net entries in June only and suggested that the second half of 2025 could see a much more important total if the interest of investors accelerates.

Analysts claim that the convergence of stablecoins, token actions and participation in Ethereum creates a convincing use case for institutional capital.

While the implementation locks almost 30% of the supply of ETH and the use of layer 2 accelerates, Ethereum is more and more positioned as the fundamental layer of the tokenization of real active ingredients. Market players are now looking at the level of $ 2,800 as the next resistance zone, which, if raped, could strengthen the bullish momentum before the second half of the year.

Strengths of technical analysis

- ETH went from $ 2,413 to $ 2,570 during the 24 -hour window ending on July 2 at 6:00 p.m. UTC, marking an increase of 6.49%.

- Consolidation between $ 2,380.83 and $ 2,460.27 lasted 4 p.m. before the start of an escape at 2:00 p.m. UTC.

- For 4:00 p.m., ETH won 2.44% with the volume of 3.5 x the average 24 hours a day.

- Solid support was formed at $ 2,554.06, buyers keeping control despite taking advantage.

- In the last hour (17:40 at 18:39 UTC)ETH went from $ 2,560.29 to $ 2,577.0 – up 0.65% with an increase of 30% volume.

- Higher hollows and very close to the peaks of the session indicate a continuous bullish momentum.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.