By Francisco Rodrigues (at any time and unless otherwise indicated)

The global markets are walking on the water while investors are waiting for the last political movement of the Federal Reserve, to come later during the day. It is almost given that the Fed will reduce the interest rates of 25 basic points. Traders will rather focus on President Jerome Powell for signs on future policy.

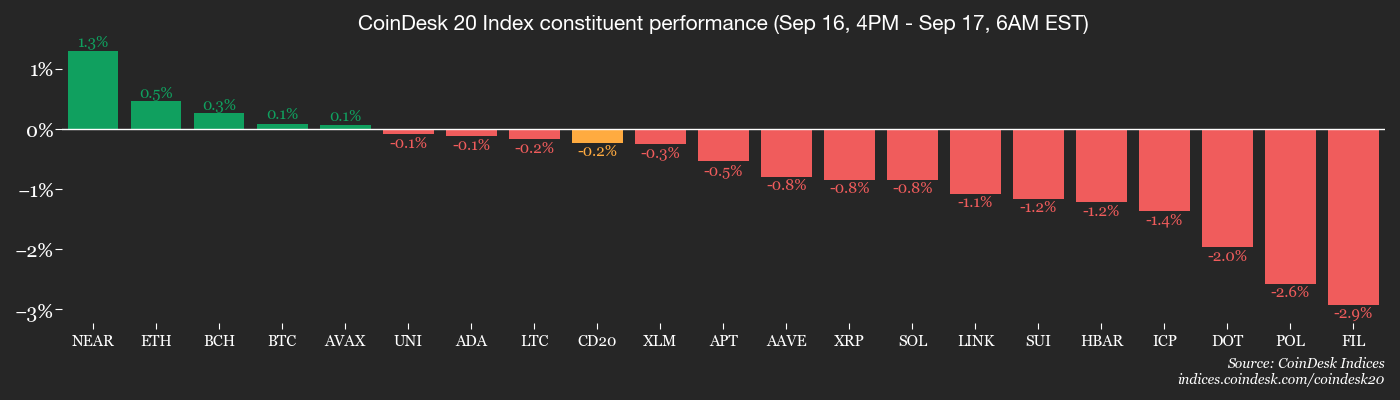

The cryptocurrency market is no different. In the past 24 hours, the Coindesk 20 index (CD20) is practically unchanged, up 0.2%, while Bitcoin (BTC) is around 1% higher. Gold, who reached a record of $ 3,700 this week, slipped 0.5%. The US dollar index added less than 0.2%.

The equity markets have also barely evolved. American actions slipped yesterday, while European actions become higher. The FTSE All-World index increased less than 0.1% today.

It’s today. But over a longer period, cryptocurrencies have lagged behind the actions.

In the past 30 days, the FTSE Allorld index increased 2.78%, while Coindesk 20 added 2.6%and BTC earned 1.6%. The movements suggest that prudence even before the drop in rates that would increase the attraction of risk assets.

Investors are currently prices in six interest rate drops. Three this year and three next year.

“Market expectations are positioned in a Goldilocks range: six cuts represent common ground between prudence and aggression,” wrote Capital QCP analysts in a note.

“A deviation in the DOT graph, however, would dispute this balance, forcing investors to recalibrate around the risk of stricter than expected conditions or a Fed which has difficulty responding effectively to lower growth,” added the analysts.

The real market test will be Powell’s press conference. A balanced message is likely to support risk assets, while hesitation would require investors to reassess.

Despite uncertainty, the request for FNB Crypto Spot remained robust. This week, the net entries for the FNB BTC Spot are around $ 550 million, while the ETHE ETF Ether reported nearly $ 300 million. Stay vigilant!

What to look at

- Crypto

- Nothing planned.

- Macro

- September 17, 9:45 a.m.: Decision of the Canada Est Reference Interest Rate. 2.5% followed by a press conference.

- September 17, 2 p.m.: Fed decision on American interest rates, including updated projections. Hne. 25 bps reduced to 4.00% -4.25%, followed by a press conference.

- September 17, 5:30 p.m.: Decision of the interest rate of Brazil is. 15%.

- Gains (Estimates based on facts)

- No planned.

Token events

- Governance votes and calls

- Mantledao votes on maintaining the 2025-2026 budget at USDC dollars and 200 million MNTs. The vote ends on September 18.

- September 17, 6 am: Dydx to host an analyst call.

- Unlocking

- September 17: ZKSYNC (ZK) to unlock 3.61% of its food in circulation worth $ 10.54 million.

- Token launches

- September 18: Deadline to convert MKR en Ciel before the delayed upgrade penalty takes effect.

Conferences

- Day 2 of 2: Summit of real assets (New York)

- September 17: The Bitcoin Treasuries NYC Uncference (New York)

- Day 1 of 3: AIBC 2025 (Tokyo, Japan)

Talk about tokens

By Oliver Knight

- Bitcoin (BTC) continues to obstinately negotiate in a tight range, increasing slightly to $ 116,000 in the last 24 hours, but failing to take momentum for a break.

- Altcoins capitalize on the lack of volatility with several points, which led to the domination of Bitcoin which slides at a lower eight months of 57%, according to CoinmarketCap data.

- Domination is a metric commonly used to assess whether capital takes place in bitcoin or more speculative altcoins, as seems to be the case.

- Another bullish factor for altcoins is that the Middle Crypto token RSI, an abbreviation for the relative force index, is 45.47. This means that altcoins are looking into a territory “occurring” as opposed to “too hidden”, suggesting that several tokens are ready for an upward extension.

- It should be noted that the domination of Bitcoin dropped up to 33% in 2017 and 40% in 2021, which means that altcoins have even more space to run.

- Many will depend on how Bitcoin acts if it starts to test the record heights at $ 124,000. An escape from a large volume will probably bring back a rotation of capital to the greatest cryptocurrency while investors will try to capitalize on a high potential cycle, personalities such as Eric Trump providing $ 175,000 before the end of the year.

Positioning of derivatives

- BTC Futures Open Interest in the main sites slipped up to $ 32 billion in last week.

- At the same time, the three-month annualized database started to compress about 6-7% again through Binance, OKX and Deribit, leaving the trade in marginally profitable portage.

- Although the growth of the OI suggests an increase in activity and engagement on the market, the narrowing basis indicates that directional conviction, in particular on the bullish side, weakens, traders less willing to pay a high premium for future exposure.

- Option data also has a complex image of the feeling of the market.

- While the graph of the structure of the terms of implicit volatility BTC shows an ascending slope curve, which suggests that the market expects long -term volatility to be higher than in the short term, other metrics indicate a more immediate bearish perspective.

- More specifically, the 25 delta bias graphic indicates that the bias is stable or slightly negative for short -term options (1 week, 1 month), which means that traders pay a bonus for calls on calls to obtain downward protection.

- This short -term lowering feeling is directly contradicted by the 24 -hour call graph of the call 24 hours a day, which shows a higher volume of calls than Put, indicating that during the last 24 hours, most options were positioned for a price increase.

- The APR financing rate in the main perpetual exchange sites has recently started to show a collection with annualized BTC financing currently 17%.

- If the upward trend is maintained and followed by other places, the funding rates would suggest an increasing conviction in a directional and more optimistic bet on prices.

Market movements

- BTC is down 0.22% from 4 p.m. He Wednesday at $ 116,637.44 (24 hours: + 1.01%)

- ETH is unchanged at $ 4,498.24 (24 hours: + 0.00%)

- Coindesk 20 is down 0.58% to 4,272.21 (24 hours: + 0.1%)

- The CESR ether composite pace is down 2 BPS to 2.86%

- The BTC financing rate is 0.0077% (8.4589% annualized) on Binance

- Dxy is up 0.14% to 96.76

- Gold -term contracts are down 0.52% to $ 3,705.60

- Silver term contracts are down 2.14% to $ 42.00

- Nikkei 225 closed 0.25% to 44,790.38

- Hang Seng closed 1.78% to 26,908.39

- FTSE is up 0.20% to 9,213.65

- Euro Stoxx 50 is up 0.11% to 5,377.98

- DJIA closed on Tuesday 0.27% to 45,757.90

- S&P 500 closed 0.13% to 6,606.76

- The Nasdaq composite has closed its doors unchanged at 22,333.96

- S & P / TSX composite closed 0.39% to 29,315.23

- S&P 40 Latin America closed up 0.52% to 2,919.60

- The 5 -year -old Treasury rate is down 1 BPS to 4.016%

- E-Mini S&P 500 Futures are unchanged at 6,669.00

- Future E-Mini Nasdaq-100 are unchanged at 24,525.25

- The industrial average index E-Mini Dow Jones is unchanged at 46,146.00

Bitcoin statistics

- BTC dominance: 58.3% (unchanged)

- Ether-Bitcoin ratio: 0.0386 (0.15%)

- Hashrate (Mobile average at seven days): 1,021 eh / s

- Hashprice (spot): $ 54.43

- Total costs: 4.18 BTC / 483 49 $

- CME Futures open interest: 144 220 BTC

- BTC Gold Price: 31.8 OZ.

- BTC vs Gold Market Capt: 8.91%

Technical analysis

- Bitcoin went from $ 107,000 to $ 117,000, now negotiating above medium-sized daily moving.

- Despite this strength, the wider bias remains cautious.

- For the momentum to continue, the Bulls will seek a decisive recovery of the daily order block between $ 117,000 and $ 119,000, an area which also aligns the weekly control block established in early August.

Cryptographic actions

- Coinbase Global (corner): closed Tuesday at $ 327.91 (+ 0.27%), -0.52% to $ 326.19 in pre -commercialization

- Circle (CRCL): closed at $ 134.81 ( + 0.57%), + 1.07% at $ 136.25

- Galaxy Digital (GLXY): closed at $ 31.83 (+ 3.44%), -1.35% at $ 31.40

- Bullish (BLSH): closed at $ 51.36 (+ 0.55%), -0.35% at $ 51.18

- Mara Holdings (Mara): closed at $ 17.53 (+ 7.94%), -0.34% at $ 17.47

- Riot Platform (Riot): closed at $ 17.52 ( + 5.04%), + 0.23% at $ 17.56

- Core Scientific (Corz): closed at $ 16.18 (-0.86%), unchanged in pre-commercialization

- Cleanspark (CLSK): closed at $ 11.20 (+ 8.84%), unchanged in pre-commercialization

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 39.86 (+ 2.92%), -1.15% at $ 39.40

- Exodus movement (Exodus): closed at $ 29.70 (+ 6.53%), -1.11% at $ 29.37

Cryptographic cash flow companies

- Strategy (MSTR): closed at $ 335.09 ( + 2.23%), + 0.21% at $ 335.80

- Semler Scientific (SMLR): closed at $ 29.11 (+ 2.54%)

- Sharplink Gaming (SBET): closed at $ 16.95 (+ 0.95%), unchanged in pre-commercialization

- Upexi (Upxi): closed at $ 5.82 (-8.06%), + 3.09% at $ 6

- Lite Strategy (beds): closed at $ 2.69 (-7.56%), + 10.43% at $ 3.07

ETF Flows

BTC ETF spot

- Daily net flows: 292.3 million dollars

- Cumulative net flows: $ 57.34 billion

- Total BTC Holdings ~ 1.32 million

ETH ETFF SPOT

- Daily net flows: – $ 61.7 million

- Cumulative net flows: $ 13.68 billion

- Total of Eth Holdings ~ 6.61 million

Source: Wacky investors

While you slept

- Metaplanet sets up American, Japanese subsidiaries, buys the Bitcoin domain name.JP (Coindesk): the sixth largest BTC treasure company in the world has formed Bitcoin Japan to manage Bitcoin-based media platforms and Metaplanet revenues based in the United States to generate income from Bitcoin.

- 21Shares strikes 50 ETPS Crypto in Europe with launch of AI and Raydium products: 21Shares introduces two products treated by Crypto exchange (FTE), a follow -up of a group of decentralized AI protocols and an exposure to the launch of the synthesis of decentralized exchange based on solar Raydium.

- Hex Trust adds the custody and jalitude of Steth de Lido, the expansion institutional access to Ethereum awards (Coindesk): the company implementation function allows customers to access stimulation awards and decentralized finance liquidity tools (DEFI) for Steth without setting up their own infrastructure.

- Three things that Great Britain wants to visit the state of Trump-apart from commercial affairs (CNBC): the United Kingdom wants Trump’s visit to progress in the unfinished trade agreement, obstacles such as steel and aluminum prices and lock the investment of Blackrock, Alphabet and Blackstone.

- Watchdog in the United Kingdom to give up certain rules for cryptocurrency suppliers (Financial Times): the FCA claims that it will adapt the regulations to the unique risk of crypto, promising more strict guarantees on technology and resilience while exploring whether investors should obtain wider consumer protections.