According to CoinDesk Research’s technical analysis data model, ether advanced on more intense trading than usual, then slipped late after a rejection from the upper band, leaving a narrower range and a clear set of control points above and below.

Analyst Commentary

- Crypto analyst Michaël van de Poppe said on

- In short: he claims that developer activity, products and network effects make the Ethereum ecosystem attractive, and that price action is approaching the type of strength seen before the records.

- How does this match up with today’s chart: The pattern shows active buyers rising, but sellers still holding the $3,860-$3,880 band. For a run into record territory, the first task would be a net recovery of $3,880 and a follow-up above the session high of $3,887.35 – steps that would show control returning to buyers near the top of the current range.

Technical Analysis Highlights

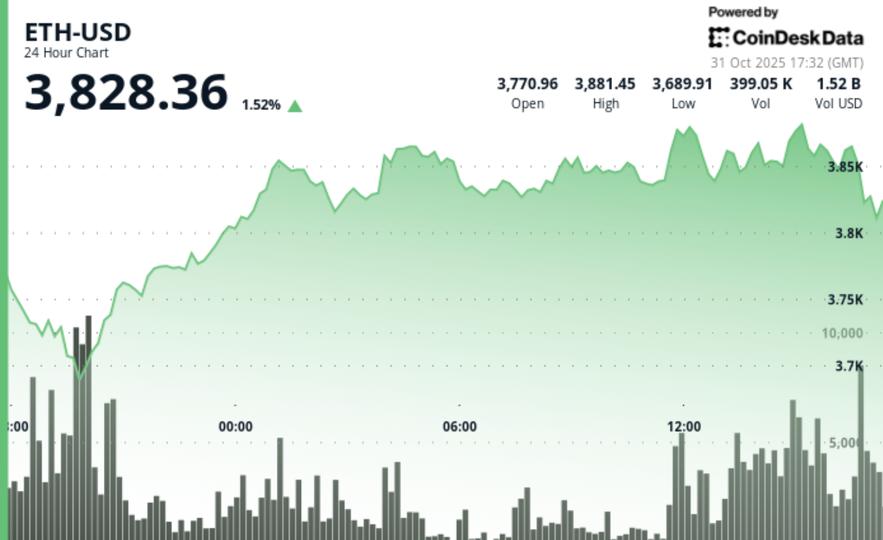

- Performance and participation: ETH +1.50% to $3,822.60 with volume +19.01% from the seven-day average; deviation from CD5 –0.06%.

- Intraday trajectory: $3,771.27 to $3,822.78 in a range of $193.66, posting higher lows throughout the session.

- Momentum peak: 2 p.m. UTC, volume $446.7,000 at $3,860, reaching a high of $3,887.35.

- Late Rejection: Last hour –1.30% from $3,869 to $3,820 on volume of 21.8K (around 6 times the session average of this phase), creating a lower high near $3,865.

Support and resistance map

- Support: $3,680-$3,720 area which detected weakness early in the session.

- Resistance: band from $3,860 to $3,880, with $3,880 as the psychological level.

- Short-term band: Trading clustered between $3,730 and $3,880 after testing the upper band.

- Session Reference: A recovery of $3,880 reopens the high of $3,887.35.

Volumetric image

- Overall: +19.01% compared to the seven-day average, indicating significant participation.

- Ahead: 446.7K at 2 p.m. UTC marked the strongest bullish impression.

- Until Close: 21.8K down from $3,869 → $3,820 shows supply hitting the cap late.

What the models suggest

- Uptrend with a warning flag: Higher lows generated an advance, but the lower closing high warns that sellers are still active near the top of the range.

- Range Behavior: With demand appearing on declines and supply between $3,860 and $3,880, $3,730 and $3,880 frame the chart in the near term.

- Next proof point: bulls would like a firm breakout and hold above $3,880; bears will look for a loss of $3,720 to expose $3,680.

Objectives and risk framing

- If buyers press: Collect $3,880 → check $3,887.35; sustained strength allows you to concentrate on the upper band.

- If sellers regain control: Below $3,720 → $3,680 becomes the next demand zone.

- Tactical Focus: With participation high but resistance respected, many traders are waiting for a clear breakout of the $3,730-$3,880 range before leaning further.

CoinDesk Index 5 (CD5) Background

- Range and Reversal: CD5 moved from $1,878.33 → $1,901.52, reaching $1,924.98 before reversing to $1,901.52, consistent with profit-taking in major currency resistance.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.