Dogecoin broke through major support zones on Tuesday, with strong whale distribution and increased volume confirming institutional-led selling pressure as traders struggled to defend the $0.16 handle.

News context

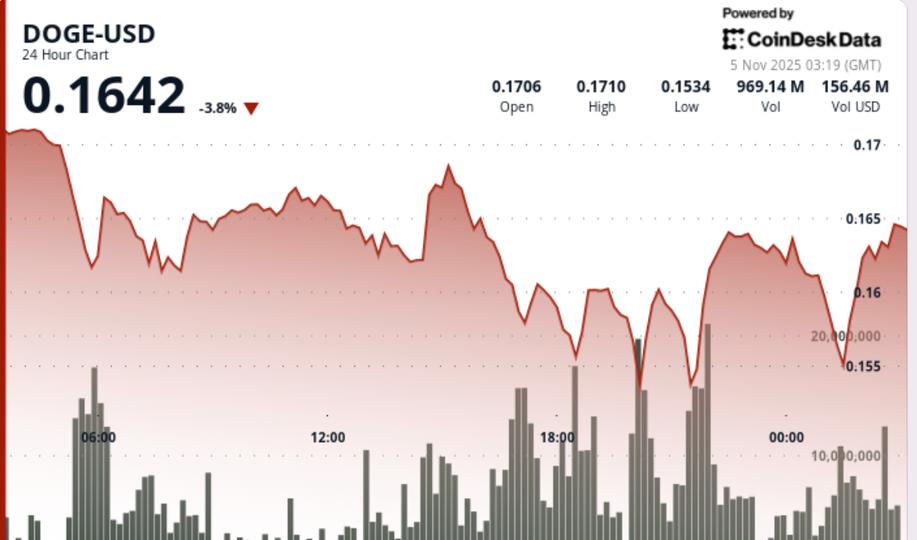

- DOGE fell 5% to $0.16, falling below critical support after an early session failure to hold the psychological $0.18 level.

- The token is trading within a volatile $0.0185 range with selling pressure intensifying throughout the day.

- The biggest declines occurred at 20:00 GMT, when trading volume reached 2.05 billion tokens – 94% above the daily average – as the price broke the $0.1590 floor. The move reflects broad institutional distribution, corroborated by on-chain data showing $440 million in DOGE outflows from large holders’ wallets.

- DOGE hit a session low of $0.1528 before settling near $0.1550, where dip buying emerged. Recovery attempts were capped at $0.1700, confirming resistance near previous support zones.

Price Action Summary

- A strong V-shaped rebound appeared on the short-term charts after the breakdown.

- However, the rebound failed to maintain its momentum, with the price consolidating below $0.1620 as overhead resistance from the breakout level remained firm.

- The late session stabilization indicated temporary exhaustion among sellers but did not yet signal a trend reversal.

- Volume skew remained bearish, with selling activity still dominating overall flow data on major exchanges.

Technical analysis

- DOGE continues to trade a formation of lower highs and lower lowsnow clear bearish momentum within a broader descending structure.

- The brief oversold bounce remains corrective rather than directional, with the overall pattern resembling a classic breakdown-pause sequence typical of distribution cycles.

- Momentum oscillators remain negative on hourly time frames, while the daily RSI has yet to recover levels below 40.

- Traders note structural improvement would require sustained closes above $0.1650invalidating the existing top-down model.

What Traders Should Know

- Traders are closely monitoring the $0.1550 to $0.1555 area, which continues to act as near-term support.

- A breakdown below this zone would expose $0.1520 to $0.1500, where deeper liquidity pools exist during previous accumulation phases.

- Conversely, a recovery above $0.1630 to $0.1650 is needed to challenge the broken resistance at $0.1590 and signal potential near-term relief.

- For now, intraday action suggests a continued distribution with limited momentum for sustained bullish follow-through.