XRP is pulling back from intraday highs amid more intense trading activity, holding above key support levels while lagging broader crypto benchmarks.

News context

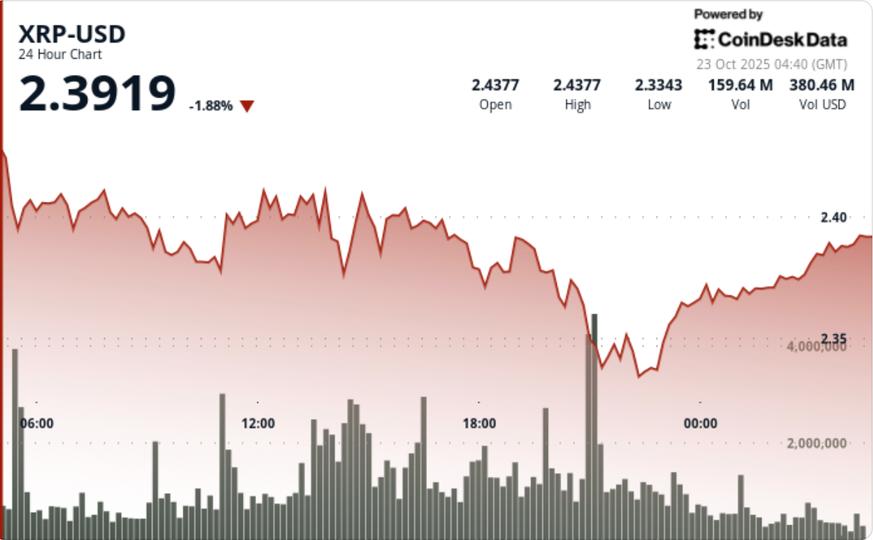

- XRP slipped 1.17% to $2.39 during Tuesday’s session, underperforming the CD5 index by 1.47 percentage points as sellers regained control in the short term.

- The move came despite a 5.77% increase in trading activity above weekly averages, signaling a tactical repositioning rather than an outright liquidation.

Price action remained contained within the $2.33 to $2.44 range, maintaining technical integrity even as market flows changed. - Traders described the move as “order book churn” – heavy rotation within a defined range – with institutions recalibrating ahead of potential catalysts.

Price Action Summary

- XRP rose from $2.44 to $2.39 during Tuesday’s session, creating a descending channel defining a 4.2% volatility range.

- The sharpest decline occurred around 9:00 p.m., when volume surged to 111.3 million – 83% above the 24-hour average – as bears pushed the price from $2.36 support to a session low of $2.33.

- Buyers re-emerged around the psychological $2.33 level, triggering a modest rebound to $2.39 on lighter volume. Resistance firmed near $2.41, with repeated rejections shaping a lower and higher structure until the close.

- The contained rally suggests positioning rather than directional conviction, with market makers managing stocks amid low conviction flows.

Technical analysis

- XRP structure remains range bound, with a descending channel forming between resistance at $2.44 and support at $2.33.

- The token’s inability to rise above $2.41 reflects near-term exhaustion, although the persistent defense of $2.33 indicates strong supply depth.

- Momentum indicators are hovering near neutral levels and volume remains high enough to support interest, but below breakout levels. Hourly data shows XRP stabilizing above the mid-range support of $2.38 while maintaining a narrower volatility band – a typical squeeze-before-breakout pattern.

What traders are watching

- Traders are focused on whether the reacceleration in volume confirms continued pressure or precedes a mean reversion push above $2.41.

- A daily close above this resistance could trigger an extension of momentum towards $2.47 to $2.50, while an extended break below $2.33 risks a return to the $2.28 area.

- Institutional desks also monitor macroeconomic correlations – including gold’s downside reversal and bitcoin’s steady supply – to gauge turnover dynamics among risk assets as volatility compresses.