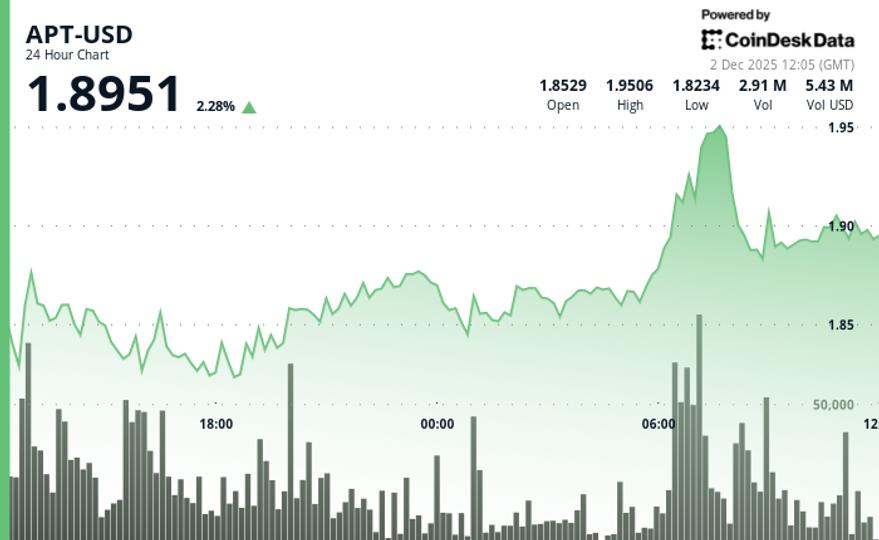

advanced 2.4% to $1.90 over the past 24 hours.

The token outperformed the broader crypto market, while trading volume soared 40% above its 30-day average. The CoinDesk 20 Index (CD20) added 1.5% during the same period.

According to CoinDesk Research’s technical analysis model, the combination of contained price movement and high activity generally indicates institutional positioning ahead of larger movements.

The model showed that the moderate price action masked the underlying accumulation dynamics that traders monitor for breakout signals.

APT set higher lows in the $0.14 range, according to the model.

The 7.6% intraday range represents normal volatility for the layer 1 token, but the increased volume suggests smart money accumulating positions without aggressively pushing prices higher, according to the model.

Technical analysis:

- Immediate support holds at $1.88 with resistance capping near $1.91, while a broader structure shows the $1.88 floor targeting $1.92.

- A volume spike of 40% above the monthly average concentrated during the morning session, indicating institutional accumulation patterns

- Three consecutive higher lows confirm an uptrend structure as momentum builds above the $1.90 pivot level.

- The next resistance at $1.92 aligns with hourly trend projections while the current level of $1.90 provides a consolidation base for further advances.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.