Technological investors like to pay the potential. Gamefi tokens, with high and bottom assessments divorced current user numbers or income, perfectly embody this optimism – as Coindesk studied in 2022, the decentraland market capitalization then of a billion dollars did not quite correspond the number of players active on the platform.

But, surprisingly, the distributed calculation tokens do not seem to take advantage of the same speculative premium even in relation to their traditional peers exchanged like Coreweave (CRWV).

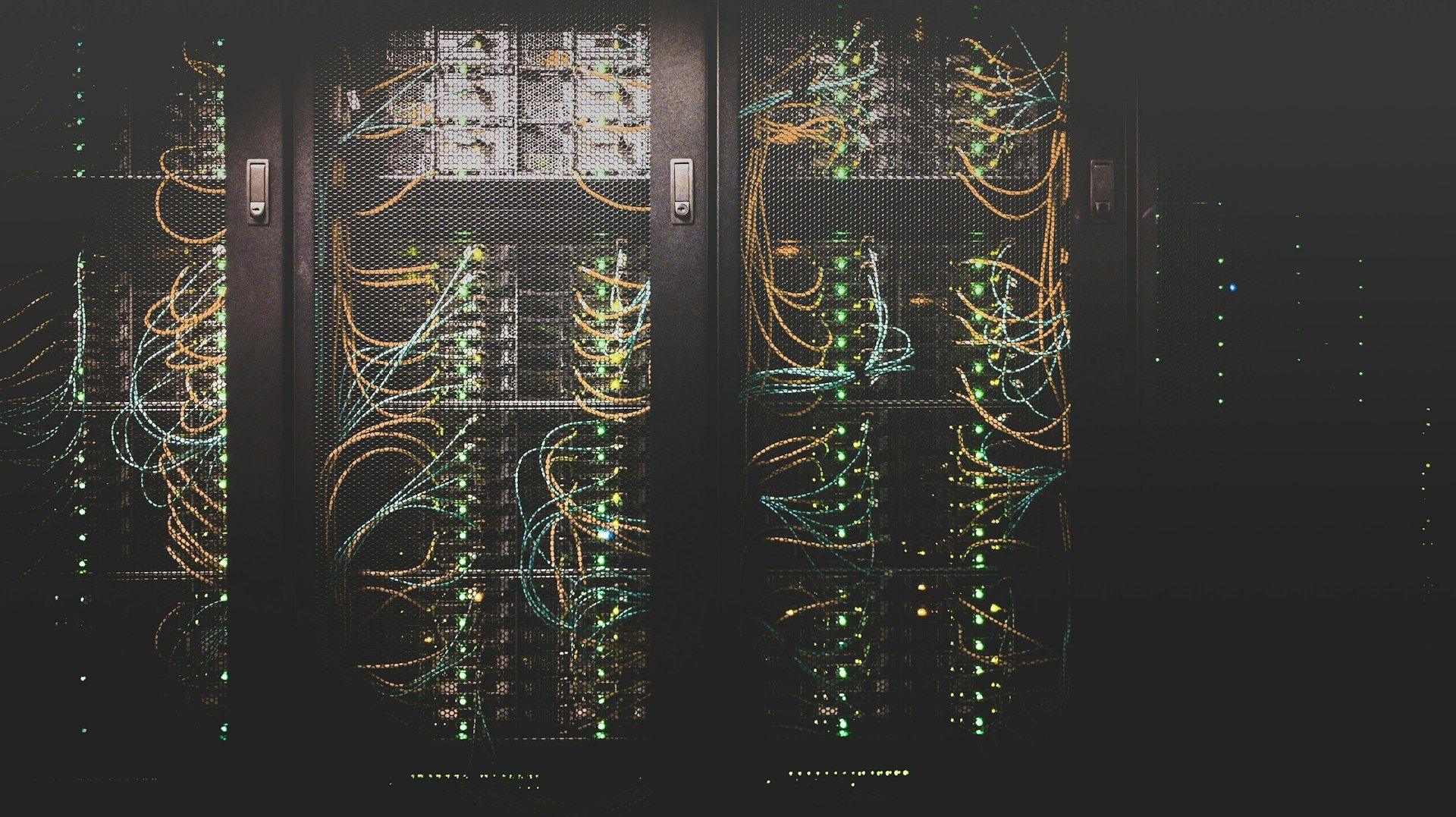

Coinmarketcapp says that the category of tokens for decentralized networks which provide GPU food for AI and other calculation workloads, which includes well -known tokens like Bittensor, Aethir and Render, is worth $ 12 billion.

At the same time, market data market data markets on markets and desmarchés put the value of the GPU as a service industry at around 8 billion dollars this year, going to $ 26 billion in 2030.

On the other hand, CRWV closed on Monday in New York at $ 163, putting its market capitalization at $ 79.2 billion. The recent results of the company provide up to 5.1 billion dollars in 2025 income, which suggests that it is negotiating more than 15 times.

This type of multiple could be justified in a strong growth environment, but Coreweave also displayed a net loss of $ 314.6 million in the first quarter, pulled in part by a share remuneration and a continuous construction of infrastructure.

Despite this, investors continue to reward Corewave for its dominant position in the centralized IA infrastructure with its stock of 300% at the start of the year. The company is closely integrated into Nvidia and has great visibility thanks to contracts with OPENAI and other corporate customers.

Meanwhile, decentralized calculation networks provide similar services – inference, rendering and calculation of energy – without having to increase billions of debts or equity, because they act as a broker connecting existing GPUs to users, saving capital expenses from the purchase of their own servers.

These are not theoretical networks. These are functional systems that already deal with actual workloads and the brokerage model works for customers.

However, their collective market value remains a fraction of Coreweave. Admittedly, they do not have the same level of workload through their networks, but the gap is striking. While the market deals Gamefi with irrational exuberance, distributed calculation tokens may suffer from the opposite problem.

Despite responding to the same market need as Coreweave, and in some respects, offering a more economical and scalable model without the CAPEX, they remain modestly appreciated.

SRM Entertainment, supported by Justin Sun, announces $ 100 million in TRX travel

SRM entertainment (Nasdaq: SRM)Soon to rename yourself as an Inc. Tron, joined all its treasure of 365 million TRX tokens via Justlend, a decision that could produce an annual return up to 10%, according to a press release.

This decision comes on an investment touch of $ 100 million closed earlier this month to finance what the company calls a “TRON cash strategy”, essentially, a public market vehicle modeled on Bitcoin restraint companies like Microstrategy, but for TRX.

This structure provides investors in shares an indirect exposure to a network that plays a dominant role in the colony of Stablecoin USDT, in particular in the world South, where the attachment based in Tron serves as a dollar rescue – undoubtedly a moment of `ipo de Visa ” for the region’s economy.

Sogni I made his Mainnet debut, Sogni Token to register on Kraken, Mexc, Gate.io

Sogni Ai, a decentralized platform for the generator WORKFLOWS, launched his MAINET and listed his native token, SOGNI, on Kraken, Mexc and Gate.io.

Sogni is the utility token of the SOGNI Supernet. It is used to calculate payments, development, governance and access to advanced application features.

The Mainnet launch includes deployments on the basis, an Ethereum Layer-2 developed by Coinbase, and Etherlink, a layer 2 compatible EVM based on Tezos using smart rollups. In a press release, the platform said that this chain approach is designed to balance scalability and accessibility.

The declared objective of the project is to create an open and economically sustainable environment for AI creative applications, combining the web3 infrastructure with user tools that resemble web2 services in conviviality.

The platform also uses a non-transferable credit system called Spark Points, which are fixed value rendering credits which can be purchased or won in the Sogni ecosystem.

Users interact with the network via three main applications: Sonini Web, Sogni Pocket and Sogni Studio. The creators submit generative AI jobs, while node operators or “workers” provide GPU resources and are paid in Sogni tokens.

Market movements:

- BTC: Bitcoin is negotiated at $ 107,200, holding a solid support area after a volume peak of 14,695 BTC nearly $ 107,000, traders looking at a potential escape around $ 115,000.

- ETH: Ethereum has rebounded strongly from an intraday drop of 3.4%, currently negotiating at $ 2,480, forming a V -resumption of $ 2,438 of support, while institutional entries continue despite a broader uncertainty of the market.

- Gold: Gold is negotiated at $ 3,310.95, bouncing a hollow of one month as a lower dollar and has fueled the feeling of pressure compensation.

- Nikkei 225: The markets in Asia-Pacific exchanged on Tuesday while investors broke the record sum heights of Wall Street against the imminent uncertainty of the 90-day Trump’s 90-day price, with the Nikkei 225 of Japan.

- S&P 500: The shares climbed on Monday while the S&P 500 increased by 0.52% for a record fence of 6,204.95, capping a strong month.

Elsewhere in crypto:

- The senator seeks to give up American taxes on small -scale cryptographic activity in Big Budget Bill (Coindesk)

- Singapore to “put on the needle” as the Crypto license rules take effect (Decrypt)

- Popular financial advisor Ric Edelman says that investors should allocate up to 40% of wealth at Crypto (Coindesk)