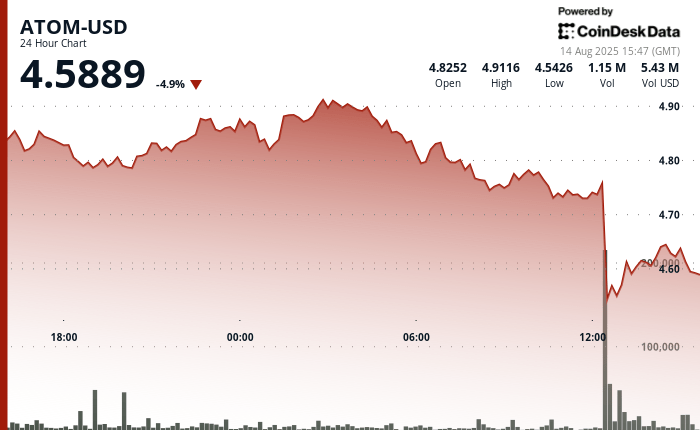

Atom-USD experienced strong volatility between August 13 at 3 p.m. and August 14, 2 p.m., negotiating between $ 4.49 and $ 4.91 with a volume of volume at 5.62 million units, more than 322% above the average. After held the range from $ 4.82 to $ 4.85 and briefly reached $ 4.91, the asset was faced with an aggressive sale from 06:00 on August 14, below $ 4.53 at 12:00 p.m. in heavy volume, reporting potential capitulation.

Buyers quickly intervened, establishing new support nearly $ 4.60 and restoring confidence in the cosmos ecosystem. This price level has become a key threshold because the sales pressure was held and trading has stabilized.

During the recovery window from 60 minutes from 1:20 p.m. to 2:19 p.m. on August 14, Atom increased from $ 4.60 to $ 4.61, culminating at $ 4.64 before consolidating in a tight range of $ 4.59 to $ 4.62. This confirmed $ 4.60 as a support base, suggesting a potential launch point for future gains.

Although resilience is obvious, resistance at $ 4.91 remains un tackled. The detention of $ 4.60 will be crucial to maintain a bullish dynamic, with any rupture risking a renewed drop pressure.

Technical indicators indicate consolidation

- Price range of $ 0.42 representing a volatility of 9% between $ 4.91 maximum and $ 4.49 minimum.

- The volume increases to 5.62 million units, exceeding the average of 24 hours of 1.33 million 322%.

- Resistance level established at $ 4.91 early in the morning of August 14.

- Support the basic formation of around $ 4.60 after the resumption of $ 4.53 low.

- Consolidation model between $ 4.59 and $ 4.62, indicating potential stabilization.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.