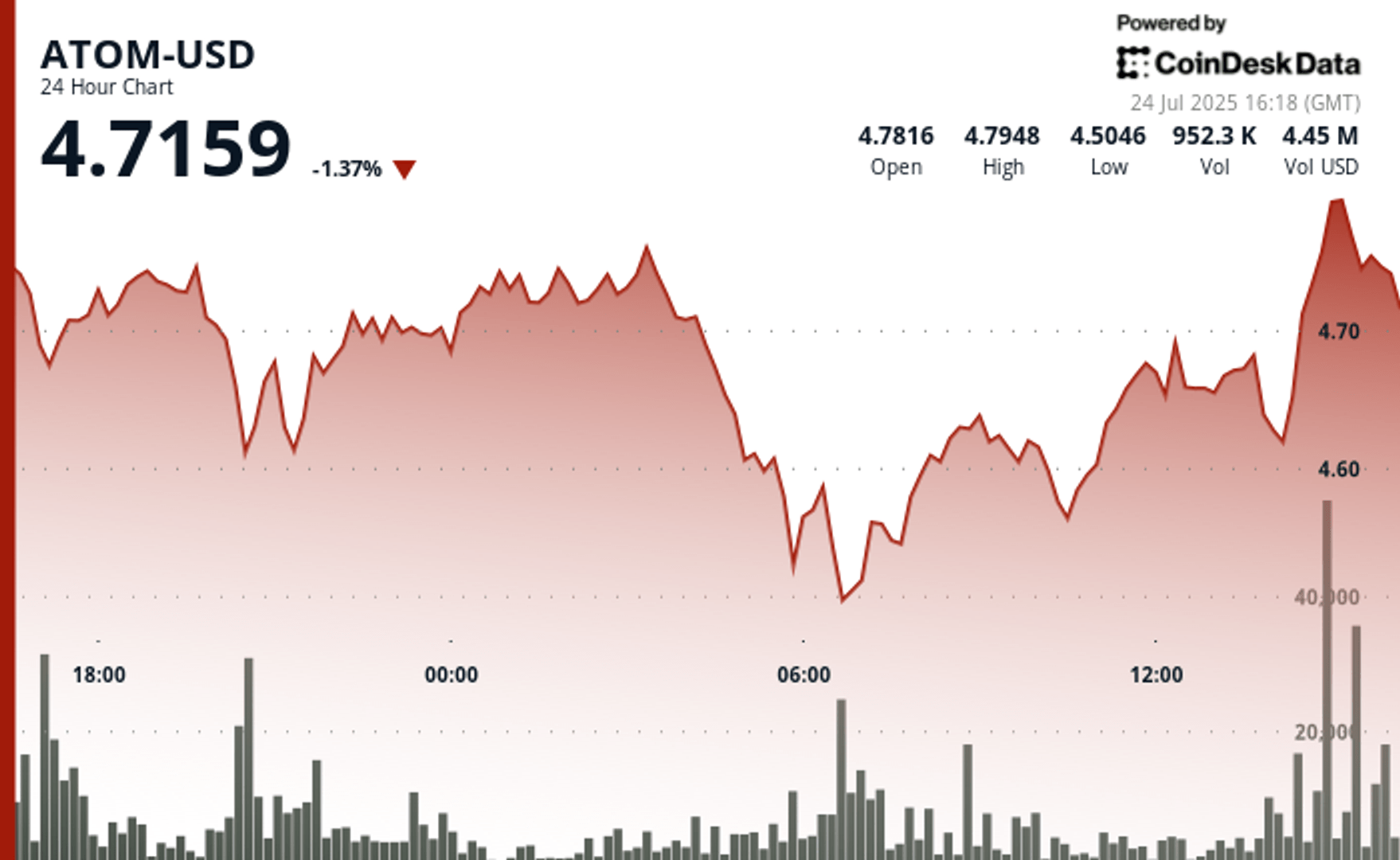

After a strong sale pressure in the early hours of July 24, Atom demonstrated an impressive resilience, bouncing with an intra -day hollow of $ 4.47 to close the session at $ 4.77. The 7% swing within 24 hours – defined by a peak at $ 4.82 and a low at $ 4.47 – was supported by a heavy volume greater than 2.28 million units, indicating a high interest at the lower limit. The rapid absorption of sales pressure and subsequent recovery reflect a robust technical basis, $ 4.47 now emerging as a level of key support.

Zooming on the last hour of negotiation, Atom has managed another shift resolution display. It opened the time at $ 4.69 and set up a sustained rally, briefly rape the resistance area of $ 4.80 over a volume greater than 77,000 units. Although this higher push has reached a rapid distribution near the summit, which led to a late diving at $ 4.74, the token has always marked a gain of 1% for the time being. The scheme underlines the taking of opportunistic profit near the resistance but does not cancel the constructive tone constructed from morning recovery.

Atom’s strong performance occurs at a time when the broader feeling of the market changes. After a week that many nicknamed the “Altcoin season” with creeping gains on second level tokens, the tide seems to turn. Several altcoins are now seeing withdrawals, weighed down by changing the appetite for risks and the gravitational traction of the BTC and the volatility of the ETH. In this context, the ability of the atom to maintain higher terrain and attract volume at key levels suggests that it can be better positioned than peers to resist this cooling phase in the Altcoin cycle.

Technical indicators highlight the key levels

- Overall negotiation plux of $ 0.33 representing 7% fluctuation between $ 4.82 maximum and $ 4.47 minimum.

- Solid volume support established at $ 4.47, an exchange greater than 2.28 million units.

- The critical resistance threshold identified at $ 4.80 with a high volume exceeding 77,000 units.

- Recovery momentum from $ 4.47 to $ 4.77 Fence indicating the absorption of buyers of the sale pressure.

- Activity for lucrative at the end of the session close to the levels of resistance while maintaining a bullish trajectory.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.