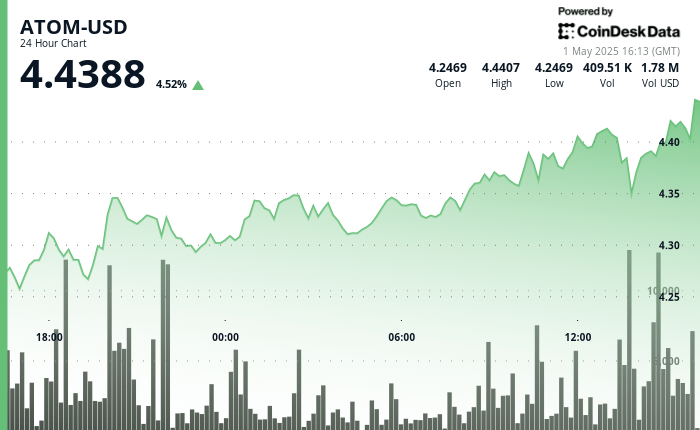

The cosmos ecosystem attracts significant institutional attention in a broader volatility context of the market, the atom showing remarkable resilience after having dropped to $ 4.23 on April 30 to stabilize above $ 4.38.

The price of the atom has increased by more than 4% in the last 24 hours, while the wider index of the 20 market gauge has climbed almost the same amount.

This recovery intervened under the name of Canary Capital Files for the first ETF SEI, built on Cosmos SDK, with implementation capacities that could create a precedent for similar products through the ecosystem.

Meanwhile, the blockchain of the source of the figure, also built with Cosmos SDK, has become the leader of the private credit tokenized with $ 9.9 billion in active loans, validating the vision of the CEO of BlackRock, Larry Fink, that “each asset can be token”.

Technical analysis: atom recovery model

- Atom-USD demonstrated remarkable resilience during the period analyzed, going from a significant drop to $ 4.23 on April 30 to stabilize above $ 4.38 by May 1.

- The overall beach of $ 0.31 (6.9%) reflects moderate volatility, with high support established at $ 4.30 at $ 4.32, according to CoindSk Research technical analysis data.

- The recent price action shows an upward trend in development with higher stockings since April 30, accompanied by an increase in volume during the recovery phases.

- Fibonacci’s retrace compared to the April 29 summit suggests that the current price has recovered the level of 61.8%, with resistance to $ 4.41 to $ 4.42 representing the next significant obstacle before the potential continuation to previous summits.

- Atom-USD has shown significant volatility in the last 100 minutes, with a sharp drop of $ 4.41 to a minimum of $ 4.35 before establishing a recovery at $ 4.38.

- Price action has formed a V -shaped model, with strong purchases emerging in the support area from $ 4.35 to $ 4.36. This was accompanied by trading volumes in particular higher during the sale (culminating at 103,987 units at 2:00 p.m.) and the subsequent recovery.

- The recent price movement has established a short -term trend with higher lows since 13:57, the current price consolidating nearly $ 4.38 to $ 4.39, suggesting stabilization after volatility and continuous rise potential if the level of resistance of $ 4.39 can be violated.

Warning: parts of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.

References:

- Bitcoinist, “”Bitcoin approaches Golden Cross while the MVRV report creates a momentum – is a break to come?“”Posted on April 7, 2025.

- Bitcoinist, “”The best presses to buy because institutional flows return to Bitcoin, explains BlackRock“”Posted on April 7, 2025.

- Blockworks, “”How private credit tokenization leads the race in the tokenization“”Posted on April 30, 2025.

- Cryptonews, “”Canari capital files for the first SEI ETF in the States“”Posted on April 24, 2025.