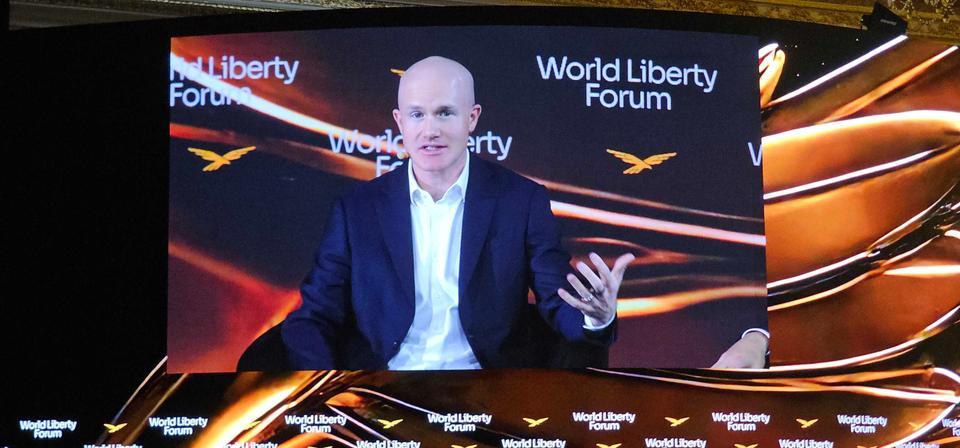

PALM BEACH, Fla. — Banking trade groups, rather than individual banks, are primarily responsible for blocking negotiations on crypto market structure legislation, Coinbase CEO Brian Armstrong said.

Banks themselves see crypto as an opportunity, he said Wednesday at the World Liberty Forum at Mar-a-Lago.

“For whatever reason, incumbent industries sometimes have trade groups and view the world with a zero-sum mindset. [where they believe] for banks to win, crypto has to lose,” he said. “They don’t see that as a positive advantage. [step]”.

Banking trade groups have represented the sector in meetings with the crypto industry hosted by the White House since the Senate Banking Committee’s efforts to advance market structure legislation failed last month. At the latest such meeting, which took place last week, the banking industry maintained its demands that the bill would block stablecoin rewards.

The next meeting is expected to take place Thursday morning, people familiar with the plan told CoinDesk.

Read more: Anti-Crypto Bankers Won’t Agree on Bill at Latest White House Meeting

Armstrong said he expected some sort of compromise in which banks would get new benefits under a new market structure bill, but did not elaborate. When the Digital Asset Market Clarity Act was blocked the day before a Senate Banking Committee hearing, it was after Armstrong publicly withdrew support for his company.

During the ongoing discussions, the Coinbase co-founder argued that small and mid-sized banks weren’t really worried about deposits leaking to stablecoin issuers, but instead said their most pressing concerns were about deposits leaking to big banks.

Big banks are also moving into crypto, he said, adding that Coinbase supports the crypto infrastructure of “five of the biggest banks in the world.”

Other banks recruit employees specializing in blockchain or cryptography on LinkedIn.

“We now live in this world where we have regulated US stablecoins with rewards,” he said. “You have to accept this as a reality and decide whether you want to view this as an opportunity or a threat.”