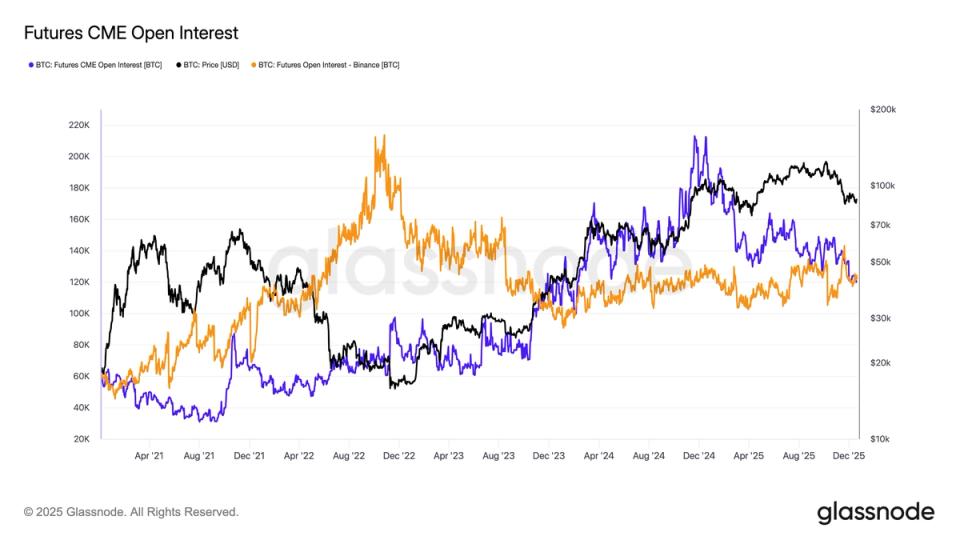

CME lost its place as the leading bitcoin exchange open interest (OI) futures contracts. Binance has now overtaken CME as the largest OI site according to CoinGlass data, with Binance holding approximately 125,000 BTC ($11.2 billion in notional value) compared to CME’s 123,000 BTC ($11 billion).

CME OI started the year at 175,000 BTC, but that level has steadily declined as the profitability of basis trading – in which traders buy bitcoin for spot while simultaneously selling futures contracts to capture the price premium between the two markets – has declined.

Open interest on Binance, however, has remained stable throughout the year, as it is the exchange most likely to be favored by retail punters betting on directional price movements.

Just over a year ago, CME OI hit a record high of 200,000 BTC as prices surged towards $100,000 following President Trump’s election victory. At that time, the annualized base rate jumped to about 15%.

Today, according to Velo data, the CME base rate has compressed to around 5%, reflecting declining returns for institutional traders.

As spot and futures prices converge and market efficiency improves, arbitrage opportunities continue to diminish. CME was the largest Bitcoin futures exchange since November 2023, thanks to its institutional positioning before the launch of Bitcoin spot ETFs in January 2024. This advantage, for now, appears to have faded.