Bitcoin

Aside, the best investment in the crypto is its “choices and shovels”, according to the CEO of the asset director of $ 1.6 Billion, Franklin Templeton.

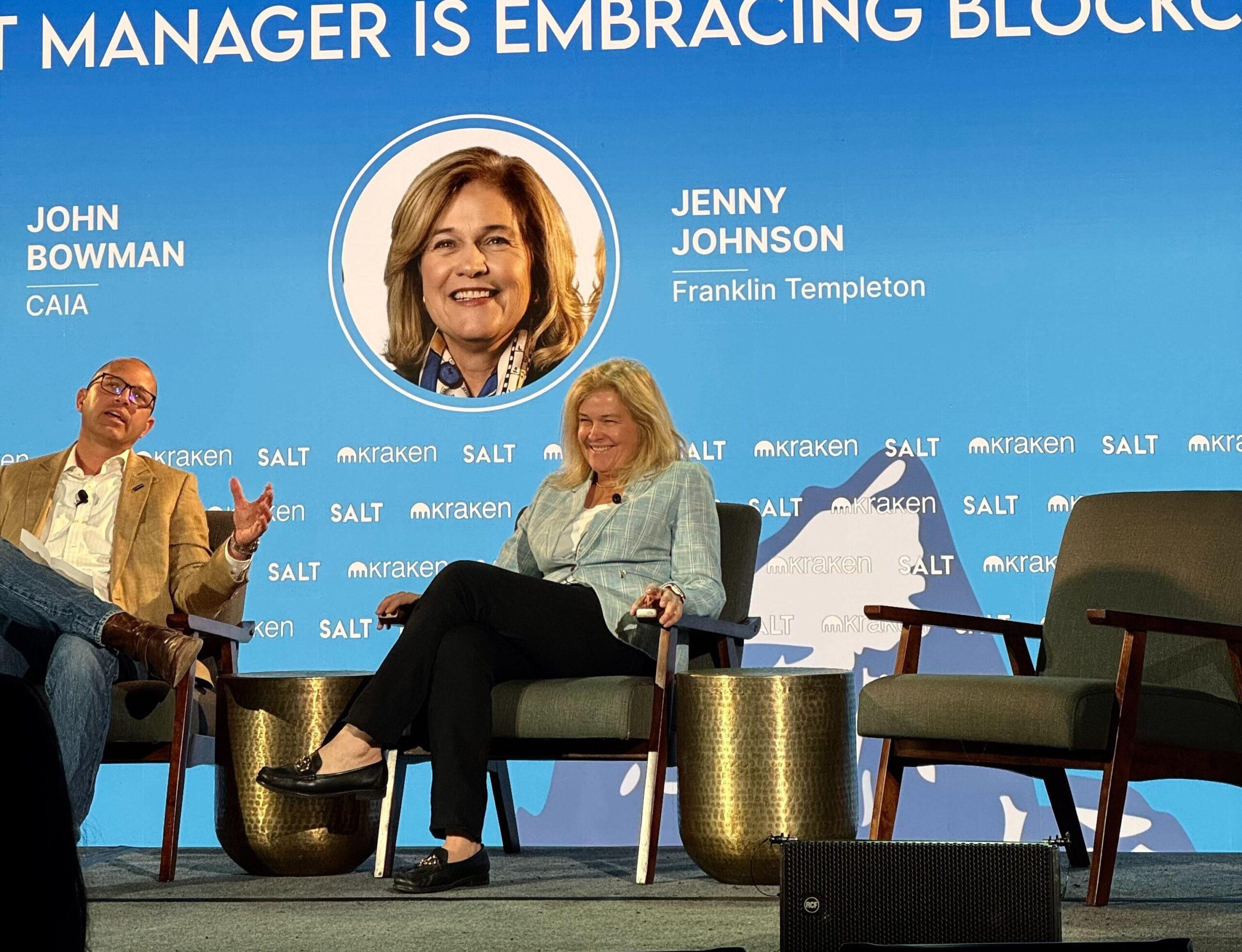

Jenny Johnson, chief of the director’s third generation, spoke on Tuesday at the Salt conference at Jackson Hole, Wyoming, to double what, in his opinion, will be the biggest cases of use of blockchain technology and where investors should put their money.

According to his opinion, Bitcoin works as a “fear currency” – a financial refuge for the inhabitants of countries where governments can block access to funds or where national currencies lose value over time. But despite her attraction in these scenarios, she considers it a distraction.

Bitcoin, she maintains, is the “greatest distraction for one of the greatest disturbances that arrives at financial services”.

This disturbance, she said, lies in the underlying infrastructure-not in the digital assets themselves, but in the systems that support them. This is where she thinks that capital should be concentrated.

“Choices and shovels are the reference base of solid and superimposed applications,” said Johnson. “I like rails as a starting point,” she added, referring to the blockchain networks. “Then there are major consumer applications that come out which, I think, are really exciting.”

She is also promising in the role of validators, the entities that maintain blockchain networks. For active investment managers, they could offer a new layer of transparency and change the situation “.

“Just imagine seeing on public equity all the transactions that enter and get out of this company and the amount of information that gives you,” she said.

Johnson managed the asset management company in digital assets after taking over his family’s company in 2020. Under its leadership, the company launched several negotiated products in exchange for crypto and introduced the US government market in Onchain, an investment vehicle in tokens.

It expects financial products such as mutual funds and FNBs possibly move to blockchains, where they could operate more efficiently and at a lower cost. But for the moment, the regulation remains the “greatest inhibitor” of this change, she said.

Part of the hesitation, she added, comes from the large number of digital assets likely to fail-a level of risk regulators is not yet ready to manage.