Global economic tensions and the uncertainties of trade policy continue to influence the markets of cryptocurrencies while bitcoin recovers a recent correction.

Despite the decline, the institutional interest remains strong with companies such as the strategy (formerly Microstrategy) and GameStop adding BTC to their corporate treasury.

Strengths of technical analysis

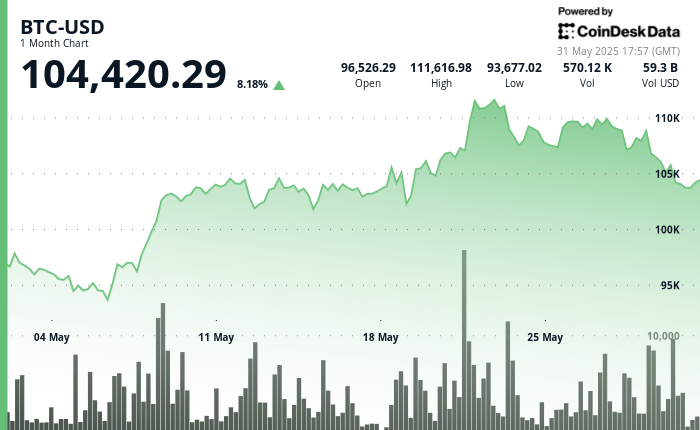

- The 24 -hour period shows a clear BOTHing scheme with a strong volume medium emerging around the $ 103,200 area at $ 103,400, where buyers were constantly involved, depending on the CoindSk Research technical analysis data model.

- The subsequent recovery phase has grown after exceeding the resistance level of $ 104,000, with an increasing volume confirming the buyer’s conviction.

- This technical structure suggests that the correction has probably ended, the price now establishing a new support base for the potential pursuit of the wider rise.

- During the last hour, Bitcoin demonstrated a notable recovery scheme, going from $ 104,146 to $ 104,303, with a significant bullish momentum emerging at 2:01 p.m.

- The price went from $ 104,188 to $ 104,323 over a significantly higher volume (429 BTC negotiated).

- The price action was a clear consolidation range between $ 104,077 and $ 104,263 before escape, with key support established around $ 104,080 at $ 104,090.

External references

- “The price of Bitcoin extends the losses – is more unknown on the horizon?”, Newsbtc, published on May 30, 2025.

- “Bitcoin at risk of failure if the level of major support fails, explains the merchant Justin Bennett – here is his targets”, the Daily Hodl, published on May 30, 2025.

- “Bitcoin Prix Prediction 2025-2031: Will BTC soon reach $ 150,000?”, Cryptopolitan, published on May 31, 2025.