The cryptography market bounces slightly from Friday’s nervousness on climbing conflicts between Israel and Iran.

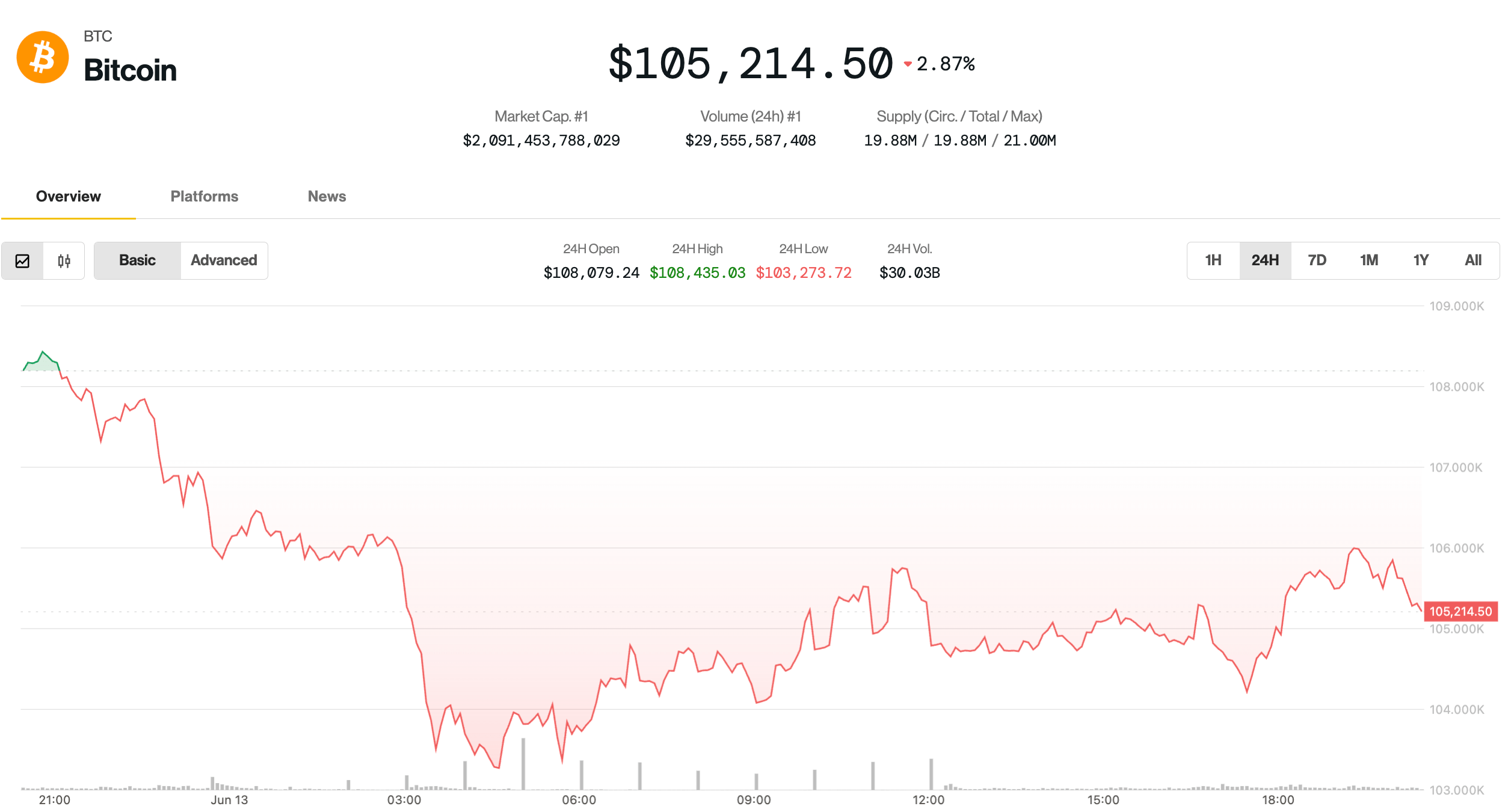

After falling at the bar of $ 102,600, Bitcoin

Rebounded at around $ 106,000 before disappearing lower in the afternoon in the United States with reports on a new wave of air strikes targeting Iran. The upper cryptocurrency dropped by 1.6% in the last 24 hours, changing hands at $ 105,200 and even less than 6% of its price of all time.

Meanwhile, Coindesk 20 – an index of the 20 best cryptocurrencies by market capitalization, excluding the same, stablescoins and exchange parts – lost 4.4% during the same period. Tokens like ether

Avalanche and Toncoin were the hardest shot, sagging between 6% and 8%.

Crypto stocks, however, are not too hot. Most actions are in red, in particular Bitcoin Mara Holdings minors (Mara) and Riot platforms (Riot), down 5% and 4% respectively. A notable exception is the Stablecoin emitter circle (CIRL), which still benefits from the windfall of its recent IPO; The title has increased by 13% today, with news of the retail giants Amazon and Walmart would have explored the stablecoins adding to the momentum.

Traditional markets do not seem extremely concerned about war. While gold is up 1.3%, potentially preparing for new heights of all time, the S&P 500 and the NASDAQ are only decreasing by 0.4% each.

What is the next step for Bitcoin?

“Until now, a good rebound and a lack of follow -up,” said the crypto trader well followed Skew in a Friday X Post. Market players will probably remain cautious throughout the weekend with the BTC closely correlated with traditional markets in increased geopolitical risks, added Sckew.

On the longer time, some analysts see the risks of a deeper withdrawal.

The founder of research 10x, Markus Thielen, noted that the drop in BTC below $ 106,000 results in a failed escape, and traders should wait for more favorable configurations before rushing to buy the decline.

He underlined the $ 100,000 area at $ 101,000 as a key support, warning that a break below could mark a return to the wider consolidation phase similar to last summer.

John Glover, investment director at Bitcoin, Lender LEDN, argued that Bitcoin had entered a corrective phase from its record heights which could see the largest digital asset drop to $ 88,000 to $ 93,000.

He said that the $ 90,000 level could offer a favorable entry to opportunistic investors before the BTC resumed its upward trend.

“Once this model took place, the next movement greater than the $ 130,000 area should start,” he said.