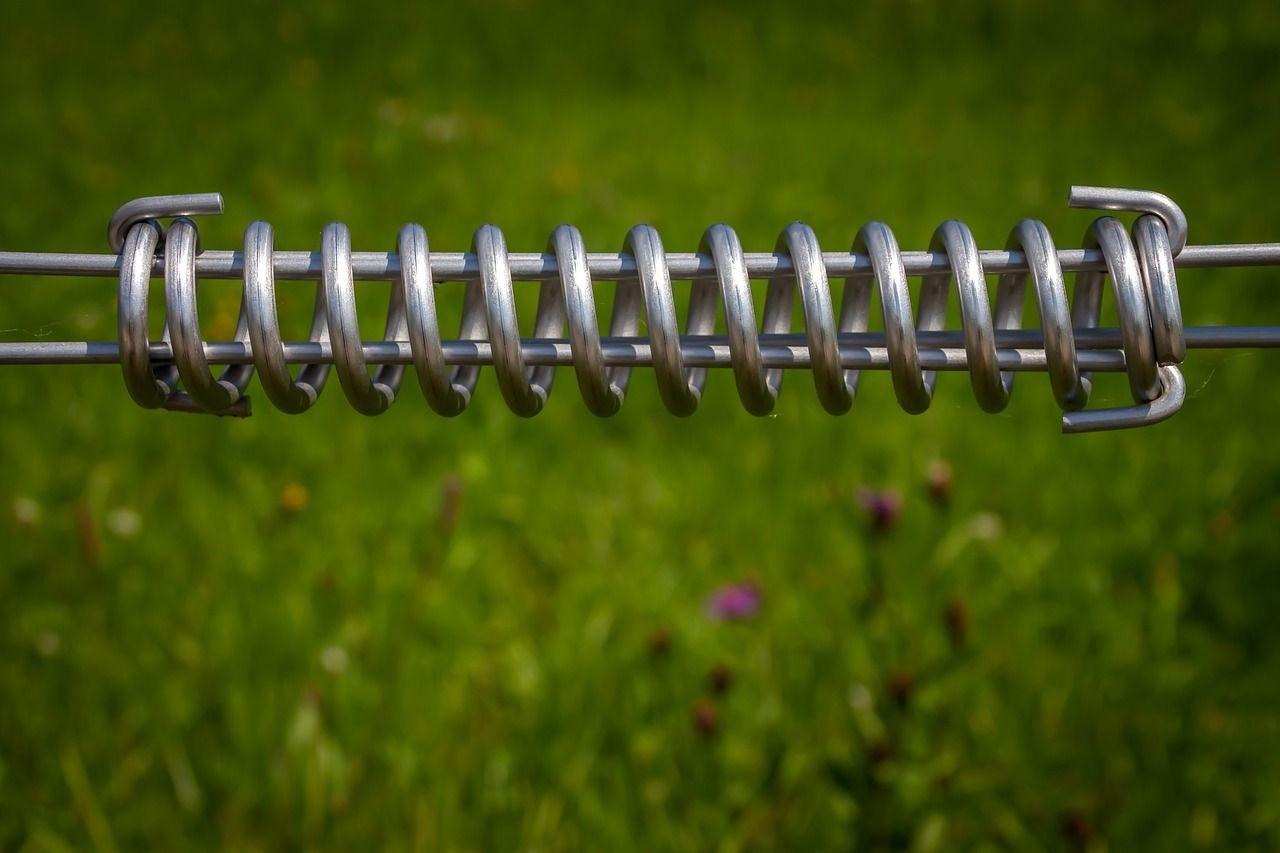

Volatility traders looking to capitalize on large price swings may soon find opportunities. A key indicator suggests that bitcoin (BTC), currently above $100,000, is like a coiled spring ready to release energy in either direction.

The indicator is the 60-day moving price range, representing the maximum and minimum price change in percentage terms. A narrower range implies stable market conditions characterized by a range play and a balance between supply and demand.

Analysis from Glassnode shows that Bitcoin’s 60-day range is now narrower than the current trading range. Historically, such patterns portend bursts of volatility.

“All of these cases occurred before a significant burst of volatility, with the majority occurring at the start of bull markets or before late capitulations in bear cycles,” Glassnode said in its weekly analysis report.

Volatility is mean reverting, that is, it tends to oscillate around its average over its lifetime. Rapid price fluctuations usually follow a period of low volatility and vice versa.

It is also independent of price. Higher volatility means that price fluctuations will become larger and potentially more unpredictable. It doesn’t say whether prices will rise or fall.

Recent flows, however, have been skewed higher, particularly on the Chicago Mercantile Exchange, where traders have been rushing into call options. A similar bullish bias is apparent on Deribit and other exchanges.

“BTC futures continue to trend higher, especially on the front end, as the market’s net long exposure from last week remains strong. Bullish bets are currently outpacing bearish bets by a ratio of “around 20:1,” QCP Capital said in a Telegram broadcast. .

If positioning is any guide, it’s safe to say that market participants are expecting a bullish resolution to BTC’s multi-week consolidation between $90,000 and $110,000.