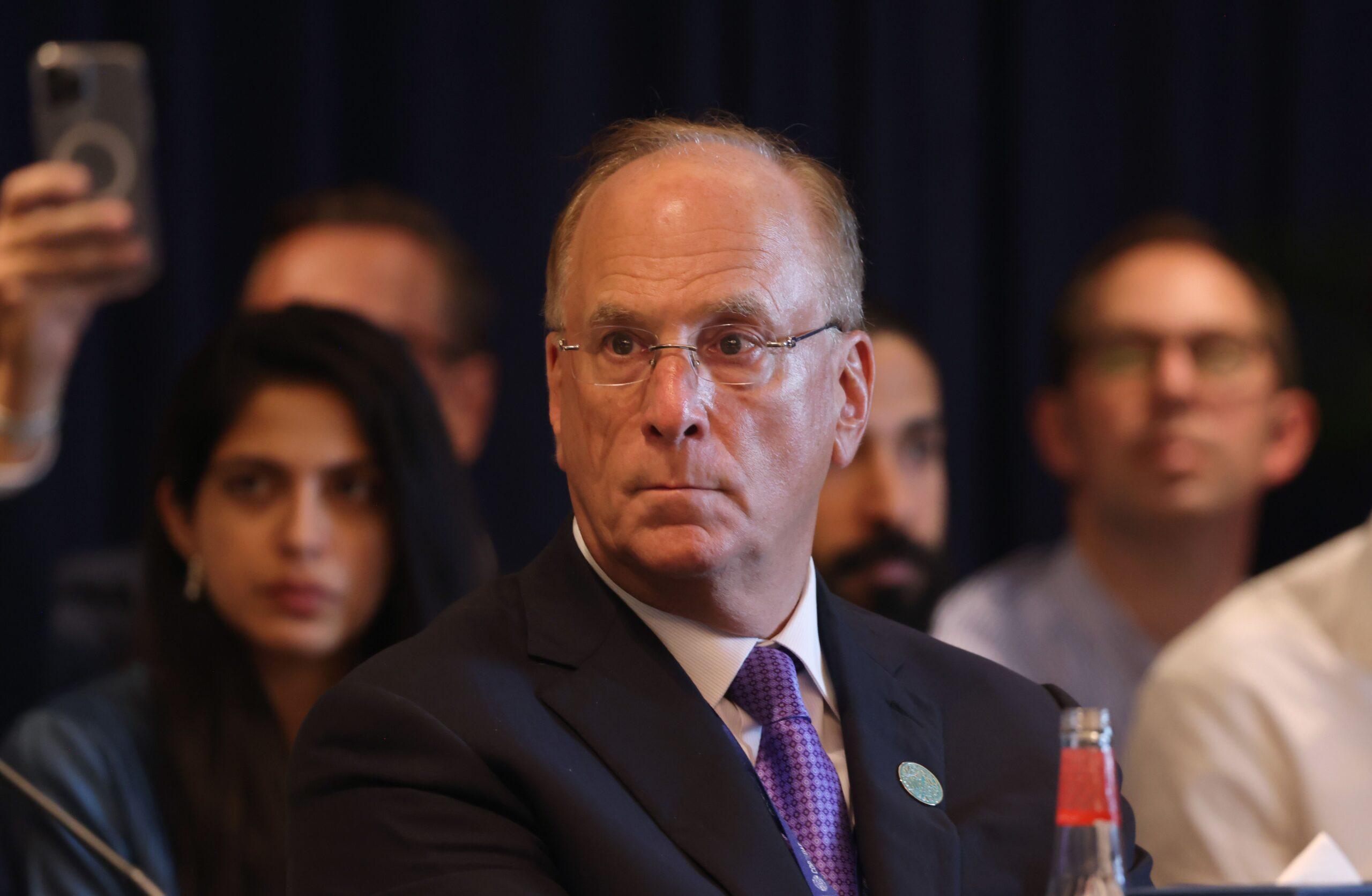

Another big fan of digital active ingredients, the CEO of Blackrock, Larry Fink, nevertheless said that he was not blind to the possible risks for the United States of the rise of Bitcoin (BTC).

“The United States has benefited from the dollar serving as a global reserve currency for decades,” said Fink in its annual letter to shareholders, but it is not guaranteed to last forever … If the United States does not control its debt, if deficits continue to ball, America risks losing this position against digital assets like Bitcoin. “”

“I am obviously not anti-numeric assets,” continued Fink. “But two things can be true at the same time: decentralized finance is an extraordinary innovation. It makes the markets faster, cheaper and more transparent. However, this same innovation could undermine America’s economic advantage if investors are starting to see Bitcoin as a more sure bet than the dollar.”

Fink’s letter comes at a time of high uncertainty and anxiety among investors about the country’s economic state in the midst of political changes put in place by US President Donald Trump. To balance the national deficit, investors said, investors should diversify their portfolios to add private market assets in addition to stocks and bonds.

Doubling his commitment and belief in digital assets, Fink said that he thought that token funds will be well known among investors as well as the funds on the stock market (ETF), provided that the industry can create a better infrastructure for digital identities, which Fink believes to be an obstacle to obtaining institutional investors from the entirely decentralized digital identity.

“Each actions, each obligation, each fund – each asset – can be tokenized. If it is, he will revolutionize the investment, “he wrote. “If we are serious about the construction of an effective and accessible financial system, the tokenization champion alone will not be enough. We must also resolve digital verification. “

Blackrock, in January 2024, became one of the issuers to launch an ETF Bitcoin to the point. Their product, the Ishares Bitcoin Trust (IBIT), has become the most successful FNB in the history of the asset class. To date, the fund has managed almost $ 50 billion in assets, half that from retail investors. The asset manager has also issued a money monetary market fund, Buidl, which is in the process of passing $ 2 billion in assets by April, making it the biggest tokenized funds currently on the market.