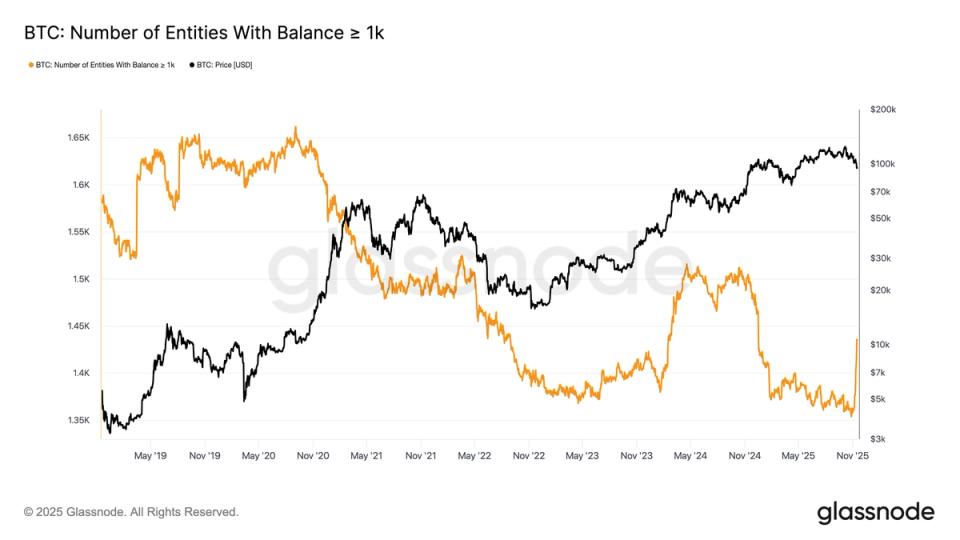

Over the past week, the number of unique entities holding at least 1,000 BTC rose to 1,436, even as Bitcoin fell and held firmly below $100,000.

This marks a sharp reversal from the broader 2025 trend, where OGs and long-term participants have been consistent net sellers.

As a reminder, this cohort peaked above 1,500 entities in November 2024, in the enthusiasm and upward movement that followed Donald Trump’s electoral victory. It fell to around 1,300 in October.

The last time a price rise was seen with an increase in the number of large holding entities was in January 2024, before the launch of US ETFs, when the number increased from 1,380 to 1,512 entities. Bitcoin eventually reached around $70,000 a few months later.

Further evidence supports this, from Glassnode’s Accumulation Trend Score, which breaks down the behavior of portfolio cohorts.

This metric measures the relative strength of coin acquisition across different balance levels based on entity size and volume of coins accumulated over the past fortnight. A reading near one indicates accumulation, while a reading near zero indicates distribution. Entities such as exchanges and miners are excluded.

For the first time since August, whales holding more than 10,000 BTC are no longer big sellers, with their score now around 0.5. Entities holding between 1,000 and 10,000 BTC are now showing modest accumulation.

The highest accumulation comes from holders holding between 100 and 1,000 BTC and wallets holding less than 1 BTC. The data suggests a growing belief among entities large and small that bitcoin is undervalued at current levels.