Bitcoin Deeply Out of the Money (OTM) Put options light up at longer expirations, as traders buy cheap lottery tickets for potential gains if BTC goes wild.

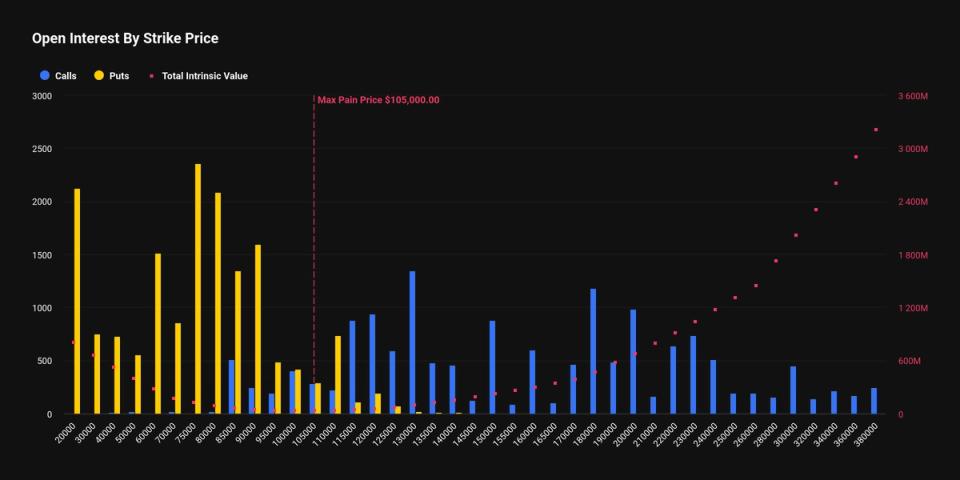

On leading crypto options exchange Deribit, the $20,000 strike put is the second most popular among June 2026 expiry options, with notional open interest of over $191 million.

Notional open interest is the monetary value of the number of active contracts. Put options at strike prices lower than the prevailing market rate of BTC are considered OTM. These OTM put options tend to be cheaper than those near or above the BTC spot price.

The June expiration also sees significant activity in other OTM puts at $30,000, $40,000, $60,000, and $75,000.

Activity in deep OTM puts is generally interpreted as traders preparing for a price crash. But that’s not necessarily the case here, as the exchange has also seen activity on strike calls above $200,000.

Taken together, these flows represent a bullish view of low-cost long-term volatility rather than a bet on price direction, according to Sidrah Fariq, global head of retail at Deribit. Think of it as cheap lottery tickets on a potential burst of volatility over the next six months.

“There are approximately 2,117 open interest in $20,000 bitcoin for the June expiration. We also saw significant trades in $30,000 puts and $230,000 calls. The combination of these very out-of-the-money options does not suggest directional trading, but rather deep trades that professionals use to trade long-term volatility on the cheap and adjust tail risk in their books,” a Fariq told CoinDesk.

She explained that this is essentially volatility positioning, not price, because the $20,000 put or $230,000 call is simply too far from the spot price to be a purely protective hedge. At the time of writing, BTC changed hands at nearly $90,500, according to CoinDesk data.

Those who hold both OTM calls and puts could experience asymmetric gains due to extreme volatility or wild price swings in either direction. But if markets remain stable, these options quickly lose value.

Options are derivative contracts that give the buyer the right to buy or sell the underlying asset at a predetermined price at a future date. A put option gives the right to sell and represents a bearish bet on the market. A call offers the right to buy.

The crypto options market, including that linked to BlackRock’s IBIT ETF, has become a sophisticated arena where institutions and whales engage in three-dimensional chess games, managing risk and profiting from price direction, time decay and fluctuations in volatility.

Generally speaking, the mood in the options market appears bearish, as BTC options continue to trade at a premium to calls across all tenors, according to Amberdata options risk reversals. This is at least partly due to the continued cancellation of call options, a strategy aimed at increasing yield on top of spot market holdings.