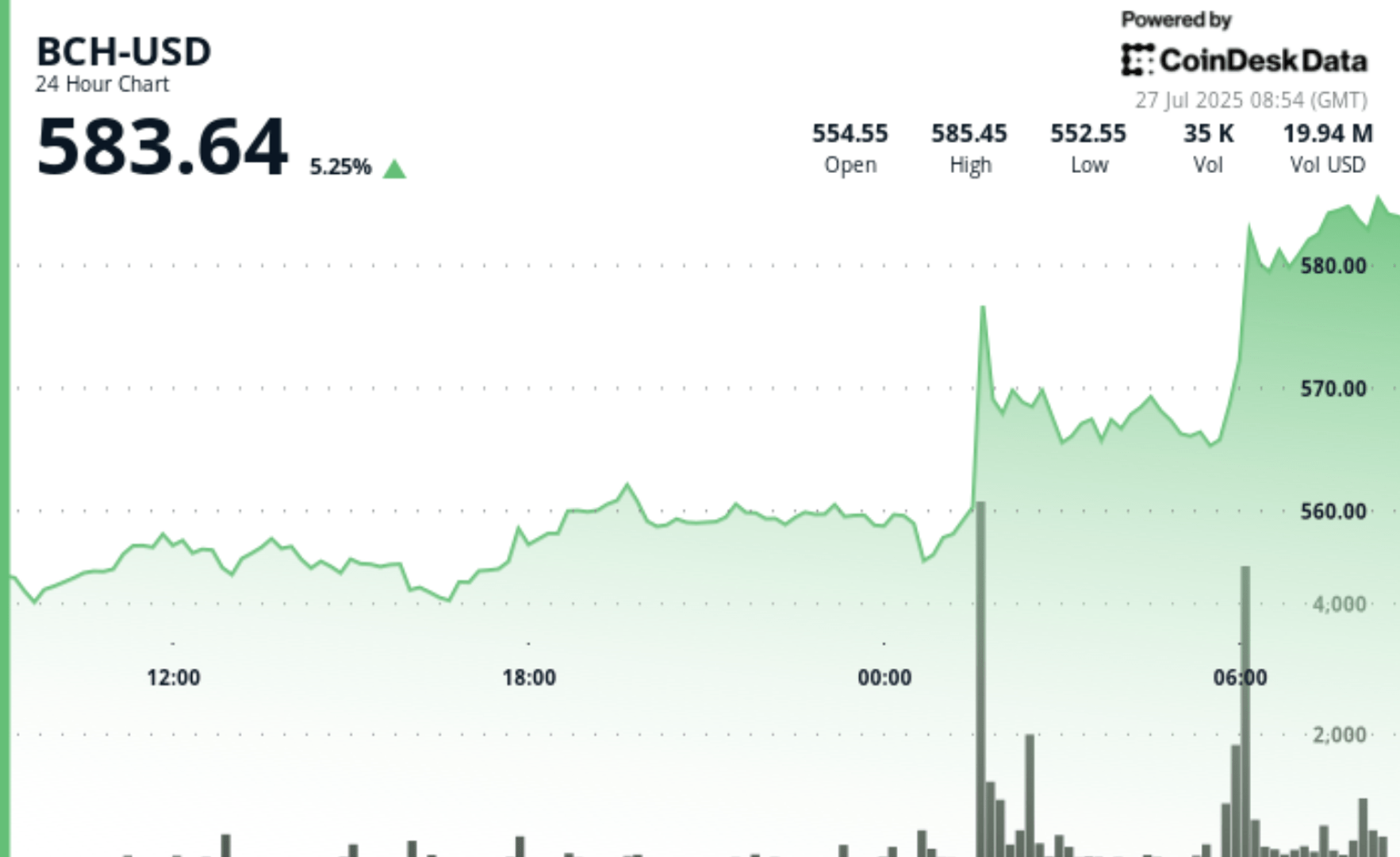

Bitcoin Cash (BCH) extended its recent gathering on Sunday, increasing by 5.25% to $ 583.64 to 08:54 GMT, according to Coindesk data. The token has now won 10.5% in last week, 15.7% in the last two weeks and 17.3% in the last 30 days.

Sunday’s escape drew the attention of several technical analysts, who pointed out bullish signs both in the action of prices and the negotiation structure.

The “CW” analyst noted that BCH “crosses the sales wall” – a traders term uses to describe a high concentration of sales orders at a specific price level. When the price crosses such a wall, this often indicates that buyers absorb this diet and that this ascending momentum could speed up. CW underlined $ 620 as the next potential target if this break is valid.

Another analyst, “Ultimae GL”, focused on the long -term graphic, observing that BCH had released a level of resistance that had held for an extended period. Long -term resistance generally refers to a price ceiling that has rejected movements on several occasions. When this barrier is broken, it can point out the start of a new upward trend. Ultimae GL warned that traders might want to wait for a “decisive escape” – which generally means a strong daily closure above the resistance – before entering, but still planned that BCH could climb up to $ 680 in the near future.

A third analyst, “XForceglobal”, described the current price structure as very optimistic. They noted that BCH remained above its so-called “basic trend” for about a month. A basic trend line is a diagonal line connecting the highest stock series in an upward trend, and a continuous price movement above, it suggests that buyers are constantly involved at higher prices – another sign of strengthening strength. The analyst described the rally as “not just good news”, but “fantastic”, given the sustained purchase activity.

Bitcoin Cash, a bitcoin fork launched in 2017, is designed to serve as a digital currency between peers with faster and cheaper transactions. Its recent ascending trajectory, combined with the acceleration of volume and configurations of bullish graphics, has renewed the interest on the part of retail and technical merchants.

Strengths of technical analysis

- According to the Technical Analysis Data Model of Coindesk Research, BCH won 5.62% during the 24 -hour period from July 26 at 9:00 a.m. UTC at July 27 at 8:00 a.m. UTC, from $ 554.54 to $ 584.66 in an intraday range of $ 33.61.

- Two major volume peaks occurred at 01:00 and 6:00 UTC on July 27, the volume culminating at 80 230 and 120,748 units, respectively.

- The support areas emerged from $ 556 to $ 558 and $ 568 to $ 570 after consolidation; Short -term resistance is established nearly $ 585.

- During the time of final negotiation, BCH increased by 0.46% additional, reaching an intra -day summit of $ 584.95. New support has been formed from $ 583 to $ 584, suggesting a current bullish dynamic.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.