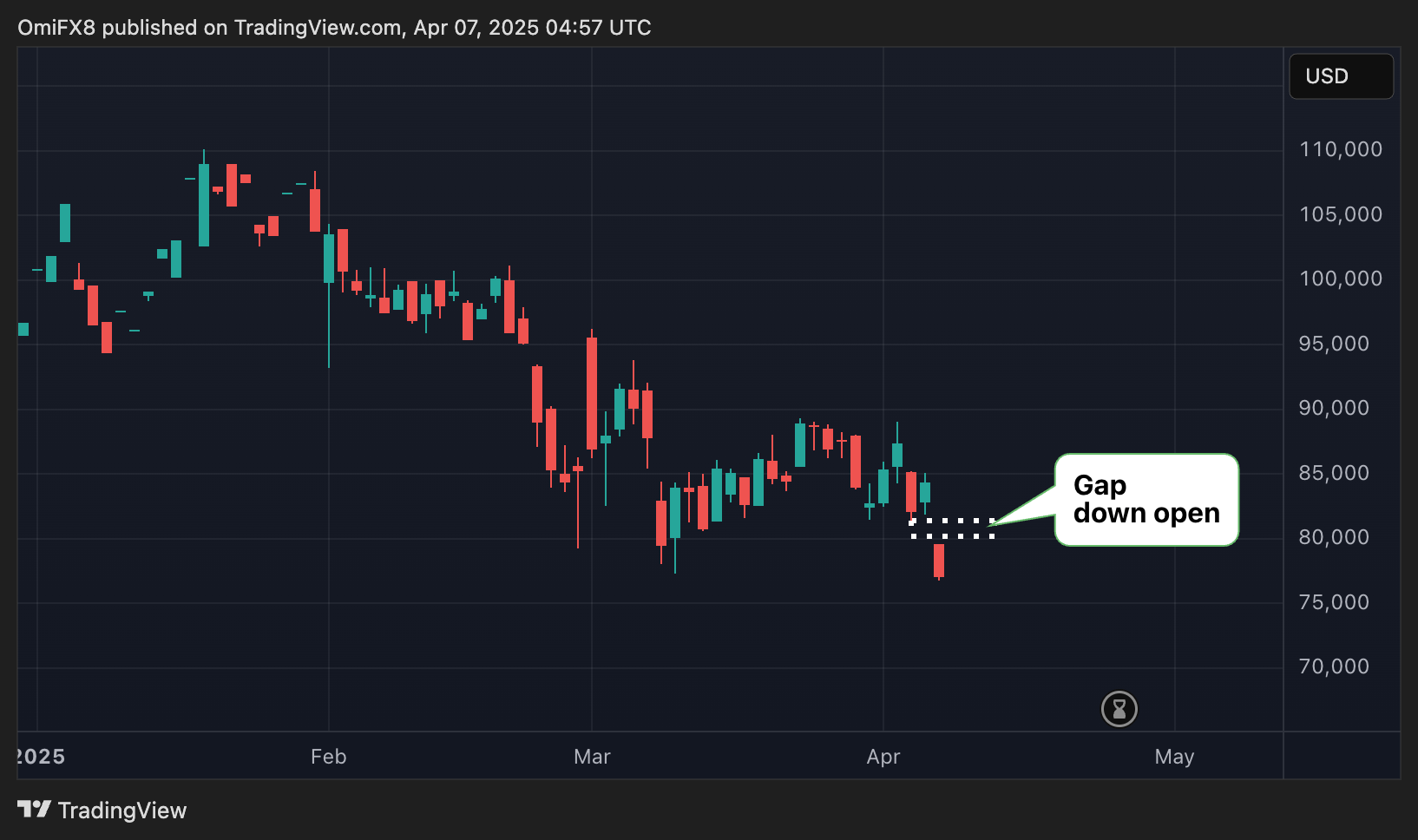

CME Bitcoin’s future Bitcoin, considered as an indirect indicator of institutional activity, made a leap on Monday below in a sign of lowered feeling after President Donald Trump excluded a trade agreement with China.

The long -term contract had to expire on the last Friday in April began to negotiate at $ 79,590, down 5.6% compared to the end of Friday of $ 84,250 and quickly dropped to $ 76,800, show the data from Coindesk.

The losses occurred while the term contracts on DOW fell 900 points, that Chinese actions crashed and the Japanese stock market has slipped into lower circuit breeze while JPMorgan, S&P Global, and Goldman Sachs have increased the probability that the United States will fall into recession this year.

Trump told journalists on Air Force on Sunday that he wanted to solve the trade deficit with China “and unless we solve this problem, I will not conclude an agreement.”

Trump added that world leaders are dying to conclude an agreement. Last week, the president announced sweeping prices on 180 nations, increasing the total levy on China at 54%. Since then, the financial markets have withered, which the president thinks is the medicine necessary to solve the problem.

“I don’t want nothing to drop, but sometimes you have to take medication to repair something,” said Trump.

Slides with open interest on CME

The open interest in term contracts on CME culminated in December at 281.57 BTC and has since fallen at 140.5k, the lowest since August 2024, according to the source of Corglass data.

It is a sign of money leaving the space of digital assets, perhaps in anticipation of a deeper price.

Meanwhile, future future and perpetual term contracts have an open interest, excluding the CME, has increased from around 400,000 BTC to 520 BTC in the past four weeks.

An increase in interest opened in parallel with a price drop would confirm the downward trend, indicating that traders build short positions on a market drop.