This is a daily analysis of Coindesk analyst and the approved market technician Omkar Godbole.

A few days ago, Coindesk highlighted three potential obstacles that could trip the Bitcoin (BTC) walking around $ 120,000, one of which was the well-established bull fatigue area above $ 116,000, in place since July. Indeed, the recent BTC rebound at lows around $ 107,200 has struck a wall, not having the breakdown decisively beyond $ 116,000 since last Friday.

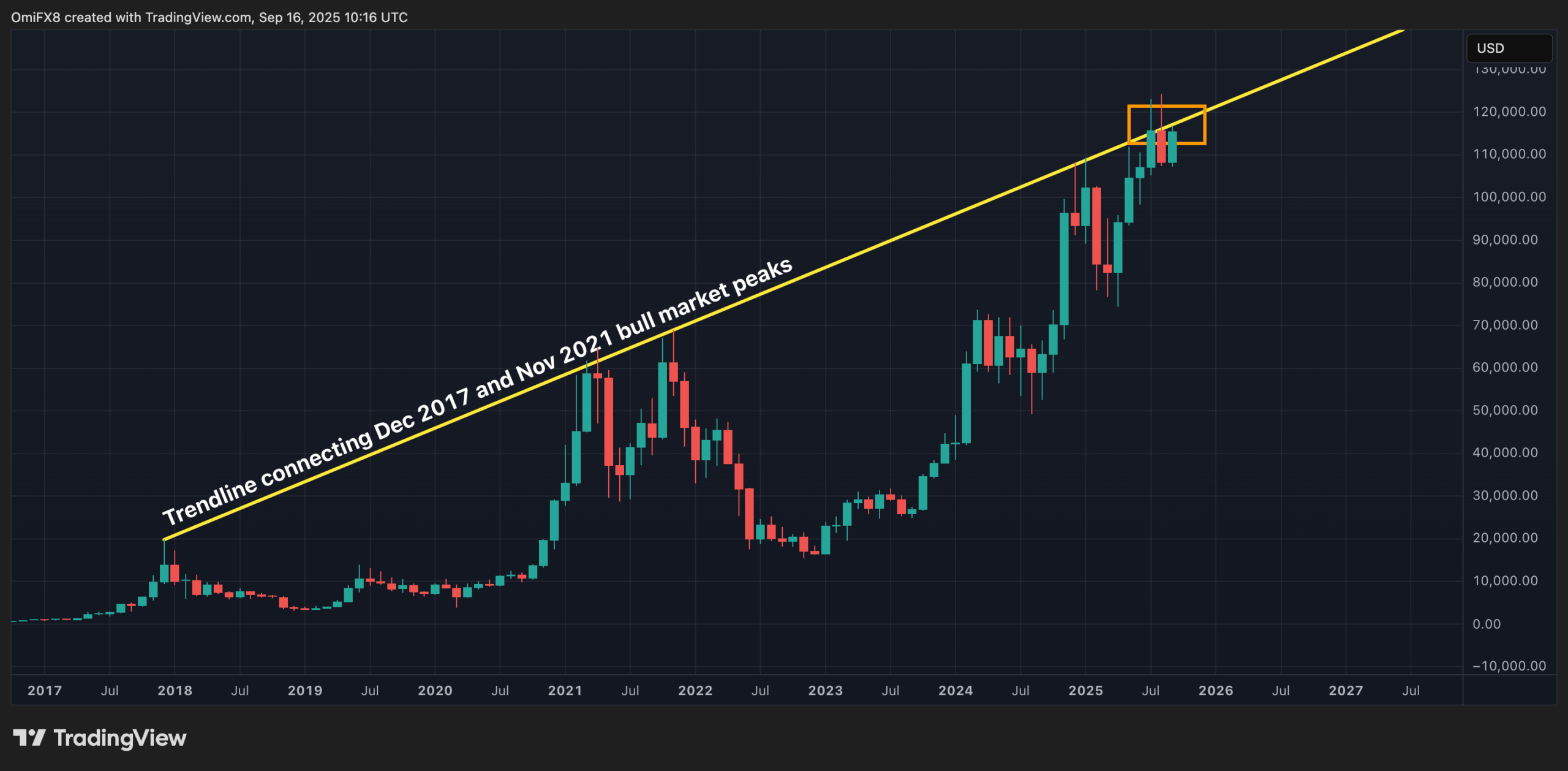

This resistance aligns closely with a key trend line connecting the peaks of the Haussier market in December 2017 and November 2021, a price ceiling that crowned the BTC increase in July and August, as shown by long upper wicks on monthly candles. The Bulls have already tried twice but could not hold above this line.

Can Bulls break it during a third attempt? Maybe. Many analysts expect Bitcoin continuing to cringen higher at the end of the year, supported by the drop in the rates of the Fed farmly awaited. But a third consecutive failure here would strengthen the hands of the Bears, potentially feeding a deeper withdrawal.

The first signs of warning a ventilation could emerge if the daily prices went below the Ichimoku cloud, currently acting as an indecision zone. During writing, Bitcoin is negotiated in this cloud, offering little directional clarity. Croisments above or below this cloud often signal movements in the momentum, so that traders must look carefully.

Warning of “Sorif Sorting” from floor

Although the enthusiasm around Solana’s price (soil) prospects remains high, the techniques suggest a note of caution. On Sunday, Sol formed a classic “star” star “candlestick after reaching a maximum of several months almost $ 250, only to drop suddenly at the end.

This model, a small real body with a long superior shadow after a prolonged upward trend, as in the case of soil, indicates that the buyers pushed the higher prices but finally lost control of the sellers, which brought the price near the day.

The lowering signal was confirmed when prices dropped to around $ 230 on Monday, indicating a possible trend reversal.

For the bulls to regain control, Sol should recover and maintain above the $ 250 peak. Otherwise, the path turns to a deeper decline, especially if the coming decision of the Fed disappoints the markets by involving a more bellicist position in the coming months.

Ether’s narrative price range

Ether (ETH), meanwhile, seems to have lost its previous momentum, deriving laterally after reaching a summit of all time almost $ 5,000 last month. Price action has formed a symmetrical triangle – a technical model representing indecision, where neither the bulls nor the bear are ready to make a decisive movement.

These triangles generally resolve with a break or a breakdown, defining the tone for the following directional movement. For the moment, it is best to wait for clear signals while Ether’s price is consolidated in this tightening range.