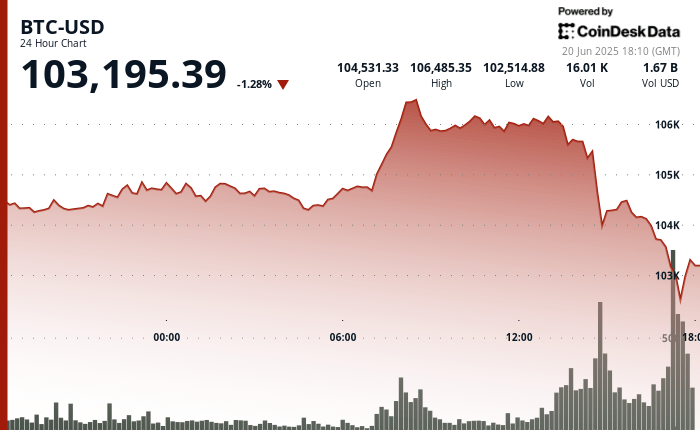

What started as a positive day for cryptographic markets quickly reversed during the American session with Bitcoin

Slide below $ 103,000 on the level of $ 106,500 a few hours earlier.

At the time of the press, Bitcoin had made some of the losses, returning to $ 103,200, down 1.2% in the last 24 hours.

Other large cryptocurrencies have undergone higher drops. Etherum ether

saw a sharp drop of 4.5% in just 90 minutes to $ 2,372, with a negotiation volume reached almost 800,000 ETH, almost eight times the average hourly volume, according to Coindesk data. Solana, Dogecoin and Cardano’s solana soil were less than 3% at 5% during the same period.

Volatility has attracted numerous off-garde merchants, liquidating around $ 450 million in derived negotiation positions on centralized scholarships on all digital assets, according to Corglass data. Some $ 387 million in liquidations were linked to long positions that bet on the benefit of the price increase.

While macro risks abound – including the current conflict between Israel and Iran – there was no immediate external reason for the sudden price switch. The S&P 500 and the NASDAQ 100 index are not lower than the day.

Bitcoin to the dead end

In a zoom, BTC continues to negotiate in a side range between $ 100,000 and $ 110,000, consolidating just below its record level of all time.

“The mixed opinion of knowing whether the BTC goes again above $ 110,000 or will fall into the $ 90,000 zone does not surprise me at all and underlines people of global indecision and the markets,” said James Toledano, chief of the Unity Wallet farm.

“The current dead end of the BTC reflects a market captured between long-term bullish feeling and macroeconomic and geopolitical uncertainty in the short term,” he added.