Gold (XAU) reaffirms its status as an active refuge in the midst of continuous fears of a trade war led by the United States, while Bitcoin (BTC) has trouble gathering upward traction. The dynamics are down the Bitcoin-Gold report.

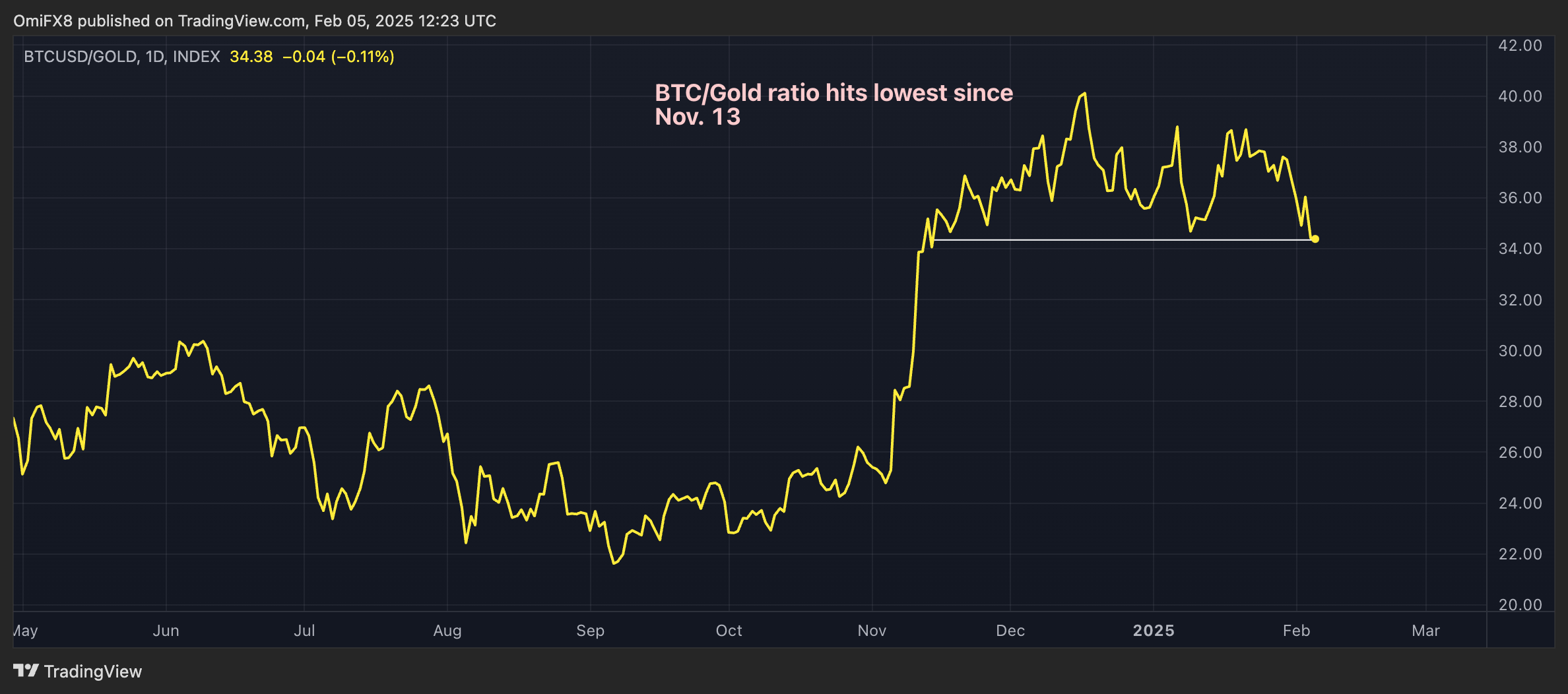

The ratio between the USD price of Bitcoin and the price by a dollar of Gold has dropped to 34, the lowest since November 14, testing almost the previous hit in March 2024, the data of the tradingView trading map platform show. It has dropped by 15.4% since it reached a peak more than 40 in mid-December.

According to Reuters, an increase in the beginning of the beginning of the year at a record price of $ 2,877 was fired by a security request in complete safety in the climbing of the American-Chinese Trade War, according to Reuters.

The tariff threat has dedicated metallic long-term prices metallic products to negotiate significantly above the cash price in recent months. This has merchants loading aircraft with American connection with yellow metal. The JPMorgan investment banks giant plans to deliver $ 4 billion in gold ingots in New York this month, according to The Guardian. In addition, Chinese gold demand has increased due to the holidays of the spring festival.

Meanwhile, the entries of the FNB Bitcoin (BTC) listed in the United States (BTC) come mainly from traders engaging in non-directional arbitration bets on the BTC, according to 10x Research.

“The purchase of the ETFs could be offset by the simultaneous sale of spots or future (holding long positions), attenuating any significant impact on prices,” said Markus Thielen, founder of 10x Research on Monday, noting the 4 billion Dollars on entry the side at the American point since the release of inflation data three weeks ago.