The crypto rally took a break long since longed Thursday while the merchants have made profits after weeks ahead of incess BTC$103 316.46 near record prices.

Consolidation occurred in the middle of a series of American versions of economic data. Retail sales in April lacked expectations, the prices of producers have increased less than expected, unemployed complaints remained on the right track, while the manufacturing index of the state of Ny Empire and the manufacturing survey of the Philadelphia Fed showed a softening of commercial activities – signals that did not do much to do traditional markets. The S&P 500 added 0.4%, while the Nasdaq finished flat.

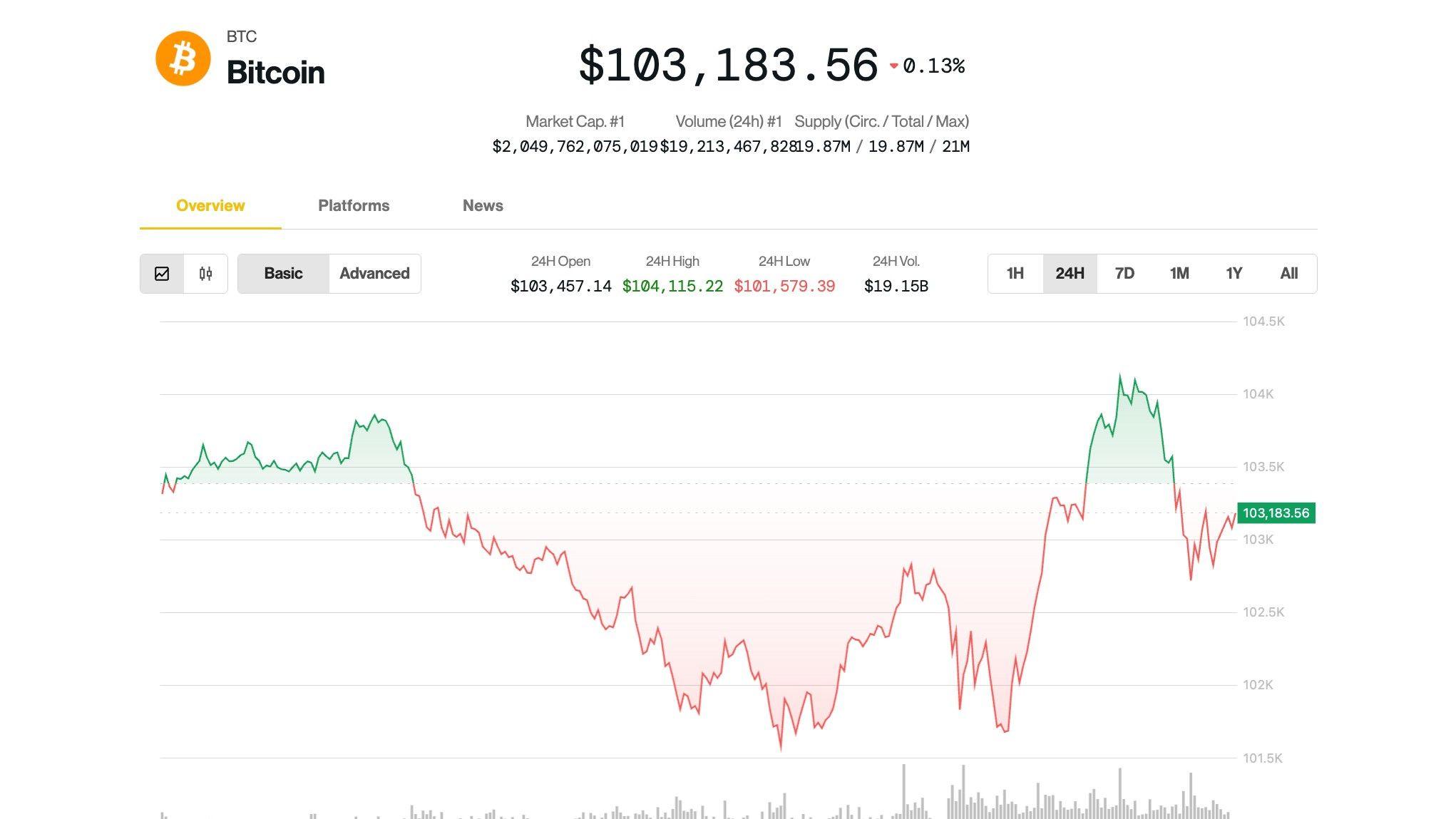

Bitcoin fell to $ 101,000 at the start of the US session before rebounding over $ 103,000 later, modestly decreasing in the last 24 hours.

Altcoins were getting out worse with the Coindesk 20 index with a large market down 3% during the same period. Native token of the Aptos Fit$5.36Avalanche Avax$23.44 and uniswap UNITED$6.23 Tumbled 6% -7%.

Cryptographic investors should not sweat today, analysts said at Coindesk.

“The current withdrawal seems to be a correction in an upward trend in the larger medium term,” said Ruslan Liardha, Youhodler markets.

The upward momentum on the stock markets has moderated after the delay in China-US, and short-term merchants began to lock the profits, he said. “This change of feeling has spread in risky active ingredients, including BTC.”

“Everything that is less than 5% [price move] Can often be considered market noise, “said Kirill Kretov, commercial automation expert at Coinpanel.” Part of this movement probably comes from taking profits, as traders guarantee gains after the recent gathering. With such thin cash, even modest sales can quickly result in notable corrections. “”

By supporting short -term movements, the action of wider prices seems healthy without a clear sign of an imminent summit.

Vetle Lunde, K33 Research principal analyst, said BTC has just left one of its funding periods lower than funding rates below

“It looks like the models opposed to the risk of October 2023 and 2024 and is far from resembling the prices action near the peaks of the past local market,” wrote Lunde, who was optimistic that the lack of foam with BTC above $ 100,000 BTC opens the way to potential fresh records.

According to Steno Research, cryptographic colors stem from a furtive expansion in private credit, especially in the United States and Europe. In past races, the crypto prospered on the expansion of basic money: massive injections of reserves by central banks that have fueled the inflation of assets at all levels. This time, however, the balance sheets of the Fed and the European Central Bank continued to shrink thanks to a quantitative tightening.

“Many have stressed China’s liquidity injections as the main engine of the rally,” Samuel Shiffman wrote in a report on Thursday. “But it lacks the brand. The real support comes from the growth of credit from the Western Bank – a quieter and less visible engine behind this decision. ”

He said prospective indicators are planning global financial conditions improving in the summer months, mainly caused by the weakening of the US dollar. This has historically led to higher BTC prices.

“We probably had room until June and early July before the image started to change,” said Shiffman. “But once we approach the back half of July, the configuration becomes more delicate. Our main indicators suggest that the peak of financial relaxation may not last August.”