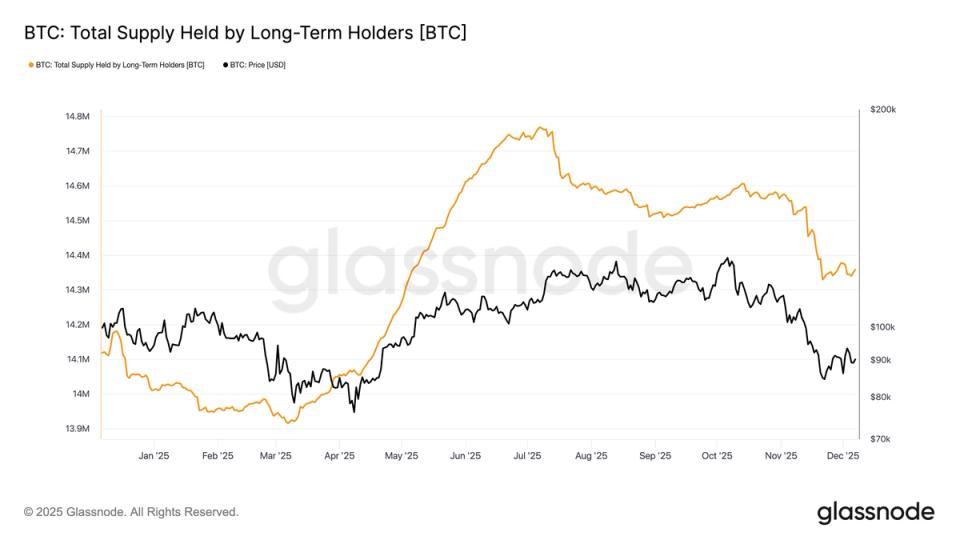

Long-term holder supply (LTH) hit a cyclical low on November 21, the same day Bitcoin peaked at around $80,000. With Bitcoin price now back to $90,000, about 15% higher than the low, the data suggests that most of the spot selling pressure has already flowed through the market following the 36% peak-to-trough correction.

This trend has become a key narrative in 2025, as persistent spot selling has been the primary reason bitcoin has traded largely flat year-to-date.

Long-term holders are defined as entities that have held their coins for at least 155 days. As coins move from short-term holders to this cohort, the supply of long-term holders naturally increases.

The recent stabilization and early recovery suggest that the distribution wave from these more experienced holders is easing significantly, thereby reducing structural selling pressure in the market.

Since the summer, long-term holders have reduced their holdings from 14,769,512 BTC in July to 14,330,128 BTC in November.

The two previous lows in long-term holder supply occurred in April 2024 and March 2025. The April 2024 decline occurred shortly after bitcoin hit its all-time high of $73,000, showing that long-term holders were distributing in force. The March 2025 low came during the correction sparked by Trump’s tariff concerns, which ultimately saw bitcoin hit its lowest level in April at around $76,000.

Looking at previous cycles, long-term holder supply typically experiences sharp declines during retail mania phases that accompany cycle peaks, notably in 2017 and 2021.

This cycle, however, appears differently. Instead of a dramatic peak followed by an aggressive distribution, the pattern was more measured, with smoother ebbs and flows. This indicates that the market structure and holder behavior have evolved, which harms the structure of the four-year cycle because the on-chain behavior is different.