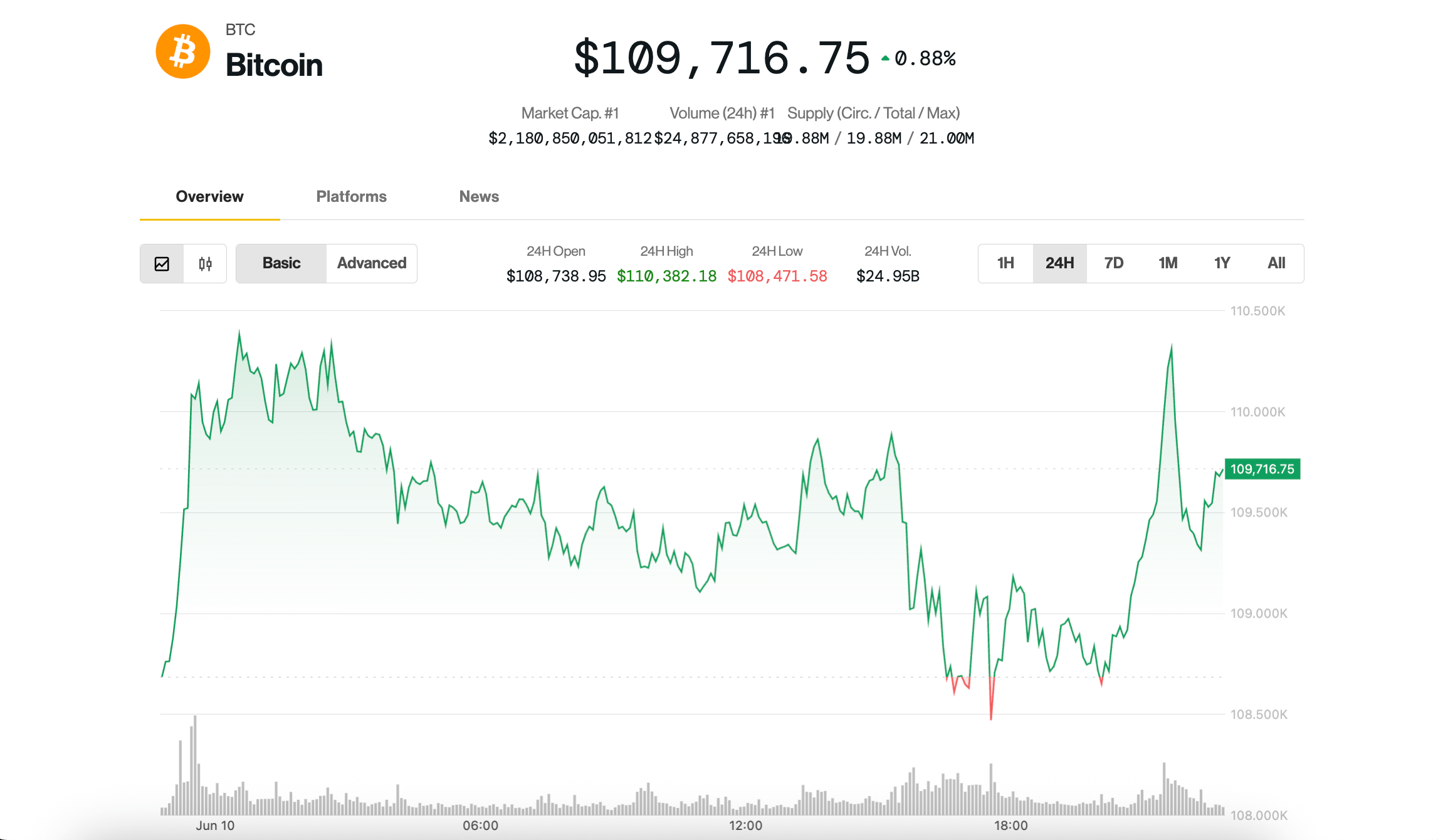

Bitcoin resumed the level of $ 110,000 for the second consecutive day, perhaps dragged above by even greater gains among altcoins.

In addition 0.9% of more than 1% in the last 24 hours, Bitcoin was just exchanging more than $ 110,000 shortly after the closing of the US stock markets on Tuesday. The Coindesk 20 – An index of the 20 best cryptocurrencies by market capitalization, excluding stabbed, exchange and even – increased by 3.3% in the same period, mainly thanks to the ether

Solana, ChainLink Gaining 5% -7%.

Outside competitions have however been implemented by Uniswap

And Aave, which has shown 24% and 13% respectively. This decision was invited to optimistic comments on the subject of Defi by the president of Securities and Exchange Commission (SEC), Paul Atkins on Monday.

Things have remained relatively calm on the front of actions, most of the cryptography stocks during the day. A notable exception is Semler Scientific (SMLR), a company that aims to follow the strategy manual (MSTR) and aspire as much bitcoin as possible. The shares have dropped another 10% today, the action negotiating now less than the value of Bitcoin on its balance sheet.

Despite the gains of the day, positioning in cryptographic markets always reflects a largely defensive tone.

“Financing rates and other leverage are directed to a constant feeling on the market,” said Vetle Lunde, research manager at K33 Research, in a Tuesday report. “Large risk appetite is remarkably low, since BTC is negotiated near the old summits of all time.”

The BTC perpetual swaps of Binance displayed negative financing rates over several days last week, the average annualized financing rate being now located only 1.3% – a level generally associated with the lower local markets rather than the summits, noted Lunde.

“Bitcoin generally does not represent a peak in environments with negative financing rates,” he wrote, adding that cases of such positioning have more often preceded rallies than corrections.

FNB Bitcoin lever flows paint a similar image. The proshares 2x Bitcoin ETF (BitX) currently has an exhibition equivalent to 52,435 BTC – Well below its peak of December 2023 of 76,755 BTC – and the entries remain in a mute. This defensive positioning, according to Lunde, gives way to a potential “healthy rally” in BTC.

However, all market observers are not convinced that the current price action marks the start of a sustainable escape.

“Is it a real escape that will continue? In my opinion, probably not,” said Kirill Kretov, senior automation expert at Coinpanel. “More likely, this is part of the same volatility cycle where we see a rally now, followed by a clear drop triggered by a negative ad or another narrative change.”

According to Kretov, the current environment promotes experienced merchants who can navigate the structure of the volatility market. Technically, he sees the next key levels of the BTC at $ 105,000 and $ 100,000 – areas that could be tested if the sale of pressure reports.