Bitcoin (BTC) Haussiers Options (BTCOIN) strategies are becoming popular again, stabilizing an indicator of crucial feeling which indicated panic at the beginning of last week.

BTC has rebounded at more than $ 84,000 since its survey of less than $ 75,000 last week. The recovery comes when chaos of the bond market would have forced President Donald Trump to capitulate on prices just a few days after announcing scanning imports on several nations, including China.

Friday evening, the Trump administration published new guidelines, sparing the main technological products such as smartphones of its Chinese rate at 125% and from the world’s 10% global fee. A few hours later, Trump refuted the news, not suggesting any relief on the prices.

However, pricing has seen the traders embraced continue to increase in BTC via the appeal options classified by Denibit. A call gives the buyer the right but not the obligation to buy the underlying asset at a predetermined price no later than a specific date. A call buyer is implicitly optimistic on the market, seeking to benefit from a planned prices increase. A put buyer would be lower, seeking to hide or enjoy prices.

“Trump’s Bond Crisis crisis fueled the price rate overturned the vocal account of the attack on capitulation, and the capitulation markets to an aggressive rebound. Protector / BTC bear $ 78,000 – $ 78,000 [strike] PUTs were thrown and $ 85,000 at $ 100,000 [strike] The calls were raised when the BTC increased from $ 75,000 to $ 85,000, “said Deribit in a market update.

The climbing of upward calls has normalized bias options, which reflects strong power biases or fears down at the beginning of last week, according to data followed by Amberdata. The bias measures implicit volatility (request) calls to puts and has been a reliable indicator of the market feeling for years.

The biases of 30, 60 and 90 days rebounded at zero, against deeply negative levels a week ago, indicating a decrease in the panic of the market and a resurgence of increasing interest. Although the seven -day gauge remains negative, it reflects a sales bias, especially lower than a week ago when it fell at -14%.

$ 100,000 is the most popular bet

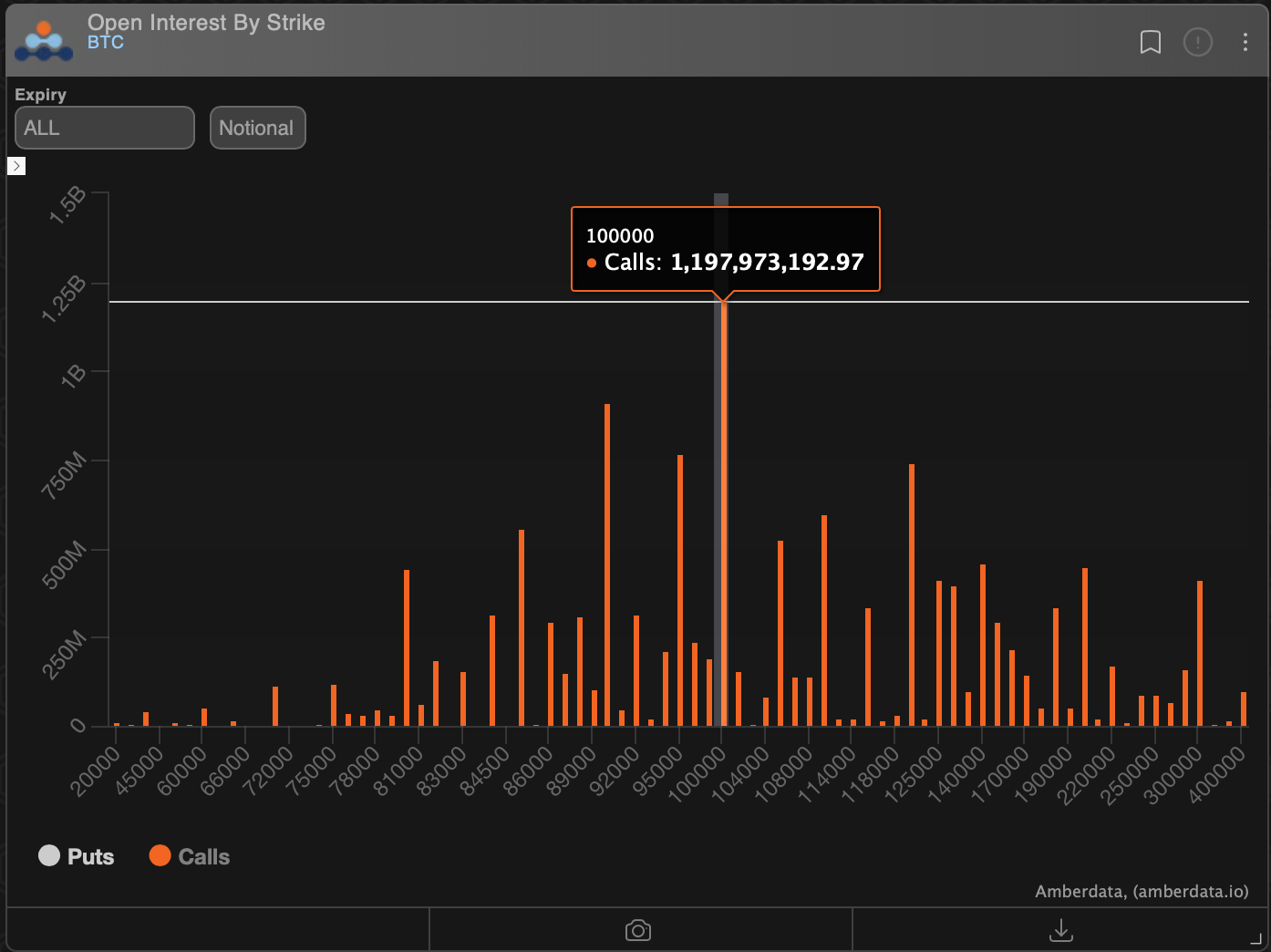

Another data point likely to boost recently beaten market players is the distribution of open interests, highlighting the resurgence of the call of $ 100,000 as the most favored option on the discomfort, which represents more than 75% of the activity of the world options.

During the editorial staff, the $ 100,000 call had an open notional interest open of almost $ 1.2 billion. The notional figure represents the value in US dollars of the number of active options contracts at a given time. Calls at $ 100,000 and $ 120,000 was popular at the start of this year before the Swoon market saw merchants deploying money in $ 80,000 last month.

The graph shows the concentration of open interest in calls in strikes ranging from $ 95,000 to $ 120,000. Meanwhile, the Put of $ 70,000 is the second most popular game with an open interest of $ 982 million.