The rally in major cryptocurrencies accelerated on Monday as Japanese stocks hit record highs and China’s third-quarter gross domestic product (GDP) data beat estimates.

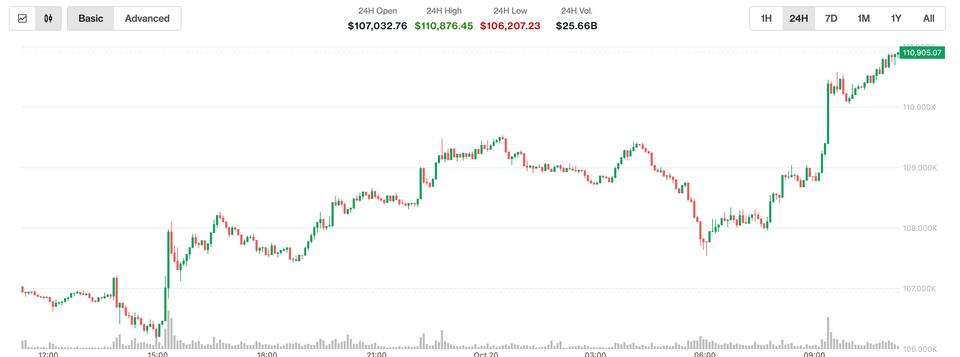

Bitcoin surpassed $111,000, up 3.7% in 24 hours after hitting a low of $103,602 last week, according to CoinDesk data. The broader market took cues from BTC, as usual, with major tokens such as ether. , Solana BNB And up 3% to 5% in 24 hours. The CoinDesk 20 index rose 3.6% to 3,685 points.

BTC’s RVT ratio, calculated as the ratio of realized cap (USD) to on-chain transaction value (USD), has fallen, offering bullish clues to the cryptocurrency.

“Historically, large declines in RVTS have preceded major bullish phases, as they indicate that Bitcoin is being used, accumulated and transferred – not just held,” crypto analytics platform Alphractal said on Telegram.

Over the weekend, Michael Saylor, executive chairman of Strategy, the world’s largest publicly traded BTC holder, teased new cryptocurrency purchases.

Positive movements in traditional markets have also provided favorable signals for cryptocurrencies. Notably, Japan’s benchmark Nikkei stock index surpassed 49,000 points for the first time on record, bringing the year-to-date gain to 25%.

The bullish move follows state media reports that fiscal dove Sanae Takaichi’s Liberal Democratic Party would join forces with right-wing Nippon Ishin, cementing his place as Japan’s new prime minister.

Takaichi has been a strong supporter of Abenomics, which represents a cocktail of low interest rates, expansionary fiscal policy and structural policy. The new bias toward Abenomics in Japan comes at a time when the Fed is expected to cut rates twice by the end of the year, and could bode well for riskier assets like stocks and cryptocurrencies.

At the same time, Chinese stocks rose 0.90%, boosted by third-quarter GDP data, which came in at 4.8% year-on-year, slightly above forecasts of 4.7%. The quarterly growth rate also beat expectations, with year-to-date GDP surpassing Beijing’s 5% annual target.

If that’s not enough, the Dollar Index, which measures the greenback’s value against major fiat currencies, fell slightly to 98.40, providing further support for dollar-denominated assets such as BTC. Gold, meanwhile, traded at around $4,250, indicating an exhaustion of the uptrend, which has historically marked the start of further BTC upside.