Bitcoin Traders started 2026 on a positive note, taking bets on options that target a six-figure price rise.

Since at least Friday, there has been a notable increase in investor interest in the January expiring $100,000 call option listed on Deribit, the world’s largest crypto options exchange by volume and open interest.

A call option gives the buyer the right, but not the obligation, to purchase the underlying asset at a predetermined price at a future date. The $100,000 call option represents a bet that the price of Bitcoin will rise above this level on or before the contract expires.

“The flow remains dominated by rolls, with a notable increase in interest around the 100,000 calls on January 30,” Jasper De Maere, office strategist at Wintermute.

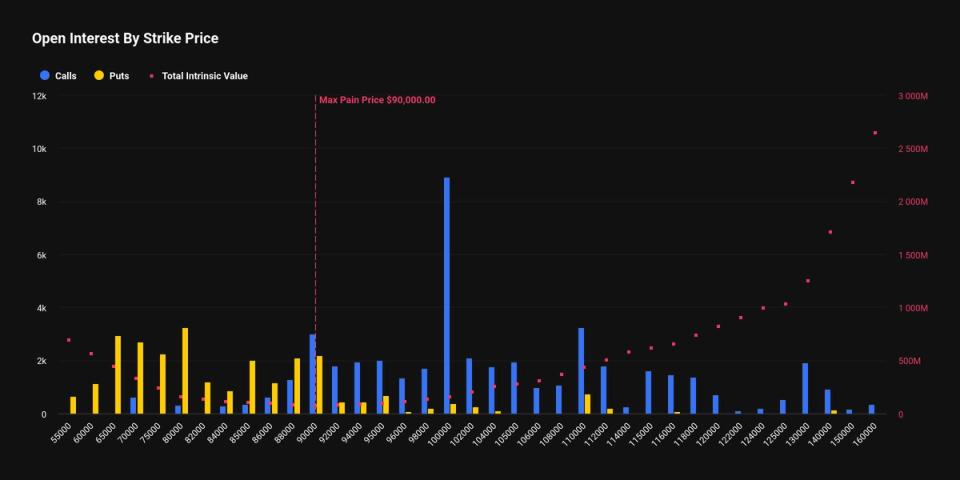

In the last 24 hours alone, according to data source Amberdata, the number of active or open contracts in this particular option increased by 420 BTC. This equates to theoretical open interest growth of $38.80 million, the highest among all January calls and for all platform-wide expirations on Deribit, where one option contract represents one BTC.

The option recently boasted a total notional open interest of $1.45 billion, with January expiration alone accounting for $828 million, according to data source Deribit Metrics.

The bullish positioning aligns with the bullish sentiment that dominated most of 2025, when traders sought call options priced from $100,000 to $140,000.

Demand for these bullish options plays could increase further if the BTC price rally extends beyond $94,000, according to QCP Capital. The cryptocurrency rose about 5% in the first five days of the year, briefly surpassing $93,000 at one point Monday morning.

“Job-[December] exhalation positioning has changed. BTC perpetual funding on Deribit has surged above 30%, signaling that dealers are now short of upside gamma. This dynamic was evident as the spot rose above 90,000, triggering covering flows into perpetual and near-dated calls,” QCP Capital said last week.

“A sustained move above 94k could amplify this effect,” the company added.