Bitcoin and the broader crypto market have started to wake up recently, but underlying liquidity conditions appear surprisingly weak, according to on-chain analytics firm Glassnode — a dynamic that echoes concerns raised in a CoinDesk analysis in November about hollow liquidity in the crypto market following the October crash.

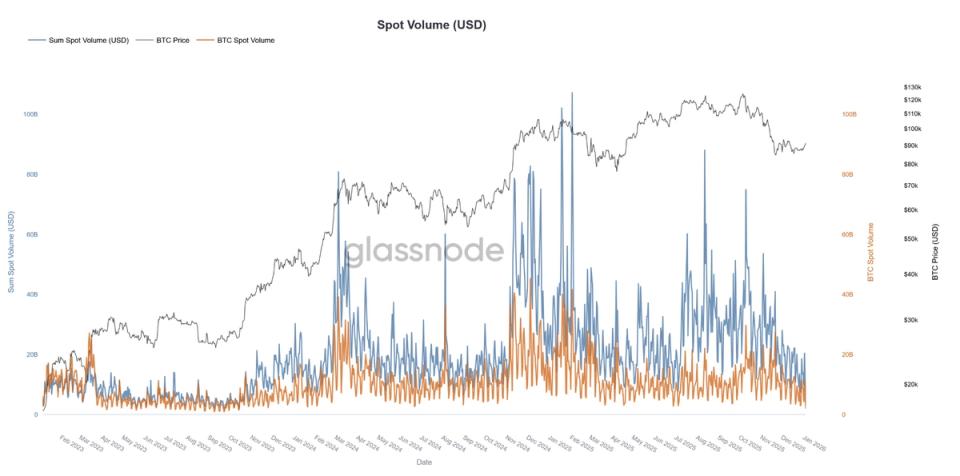

The latest data from Glassnode shows that bitcoin spot trading volume and overall altcoin spot volume have fallen to their lowest levels since November 2023, even as prices have climbed – a divergence that generally indicates diminishing market participation and fragile demand under recent strength.

Spot volume is a metric that assesses actual buying and selling activity on exchanges, a barometer of real trading interest.

Traditionally, healthy price increases are supported by increased volumes, as new capital and buyers enter the market. But in this case, not only did spot volumes not rise in line with prices, they fell to their lowest level in a year, highlighting the lack of broad participation behind these moves.

Loading…

This assessment reiterates issues raised in a CoinDesk research article published in November, which documented how liquidity on centralized exchanges – including market depth for bitcoin and ether – failed to fully recover after October’s liquidation cascade.

The study found that after the crash, order book depth remained structurally lower than before the selloff, suggesting a new, thinner liquidity base that makes markets more vulnerable to overreactions in prices.

The October event, which caused $19 billion in leveraged positions to disappear in a matter of hours, did more than unwind excessive betting. This reshaped the underlying structure of the market, leading to a sustained withdrawal of quiescent liquidity as market making firms and liquidity providers withdrew, making markets shallower and less able to absorb large transactions without significant impact on prices.

Bitcoin is currently trading at $93,500 after rising 7.5% since January 1, but the move to minimum volume presents traders with a number of warning signs.