The Rapid Price Rally of Bitcoin took the merchants off guard, triggering major liquidations of short hobs.

The main cryptocurrency per market value has increased by more than $ 102,500 in the past 24 hours, prices exceeding $ 104,000 at a given time since January 31. The Haussier move came while President Donald Trump announced a complete trade agreement with the United Kingdom and the cumulative entries in the Spot exchanges (ETFs) have reached a record greater than $ 40 billion.

The wider market has also joined, with the total market capitalization of all parts excluding BTC from 10% to 1.14 dollars, the highest since March 6, according to Data Source TradingView.

This has led to substantial liquidations of short lowering positions or leverage games aimed at taking advantage of price losses. A position is liquidated or forced to close when the balance of the trader account falls below the required margin level, often due to unfavorable price movements. This leads the exchange to close the position to automatically avoid additional losses.

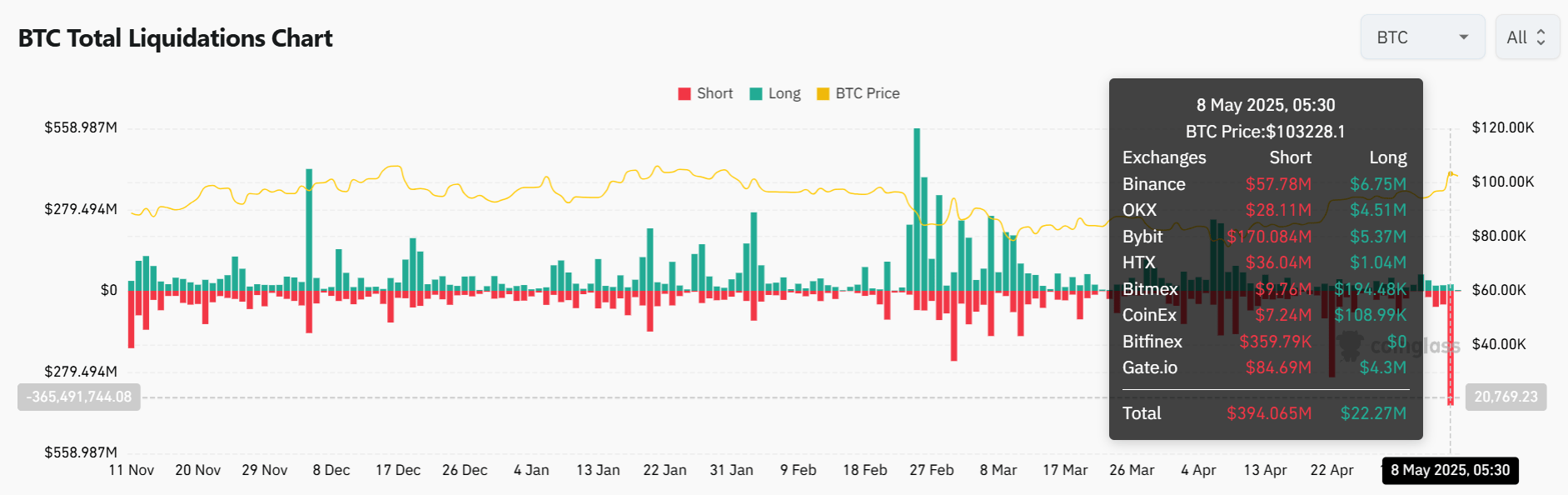

According to Coiinglass, nearly $ 400 million in short BTC positions have been liquidated in the past 24 hours. Meanwhile, $ 22 million in long positions were also destroyed.

This significant imbalance indicates that the lever effect was strongly tilted towards the bearish side, and the rapid liquidation of shorts suggests that there could be potential for the upcoming market.