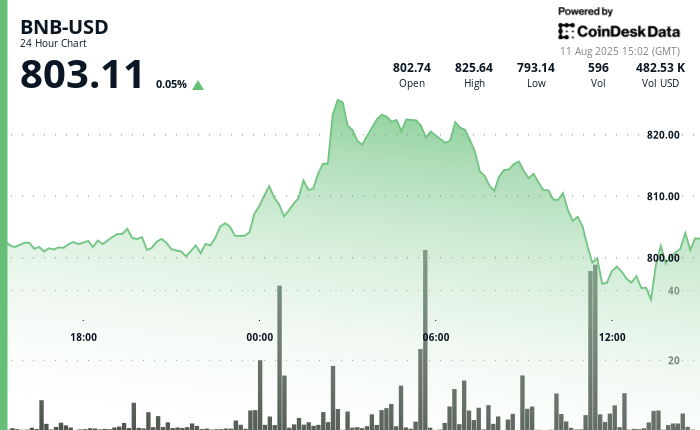

BNB saw turbulence during the last period 24 hours a day, undergoing a swing of 4% over the period between the fork of $ 793 and $ 827, before settling just above $ 800.

The token initially increased to a peak of $ 827 while the rally started, with more than 146,000 tokens exchanged in an hour before the sellers intervened to reserve these gains.

Trading has since been jerky, short -lived recovery that has not been able to decisively break the resistance levels nearly $ 800. Despite volatility, BNB cash purchases did not hesitate, the CEA industries becoming the largest business holder in cryptocurrency after a purchase of $ 160 million.

This decision pushed the BNB market capitalization to nearly $ 112 billion, cement of its fifth largest cryptocurrency position by market capitalization.

While the price swings shaken the merchants, the underlying demand suggests a continuous long-term participation.

Preview of technical analysis

The negotiation range of $ 33.34 of BNB over the 24 -hour period represents a 4% volatility band between its bottom of $ 793.99 and $ 827.33. The rally stalled at the resistance level of $ 827.33, where high -volume -shaped capsules. The support formed nearly $ 794, reinforced by heavy purchases during morning correction.

Short -term resistance is nearly $ 800.50, where multiple recovery attempts have failed despite intrajournial volume tips.

An escape above this level could be tested $ 811.22 and open the way to $ 827.33. Ventilation less than $ 794 risks more risk towards the descent to the $ 780 zone.

The volume profile shows two key liquidity zones: a morning overvoltage of 146,403 units negotiated in resistance and a hunt for a single unit of 114,685 units, which indicates a strong institutional participation. These areas can guide short -term price reactions if volatility persists.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.