Binance Coin (BNB) has climbed in the past 24 hours while geopolitical tensions shaken the markets, motivated by the rise in the use of the BNB chain, which recorded more than 16 million transactions per day earlier this month.

This transaction figure marks a massive leap from the 4 million transactions per day processed earlier in the year, according to Nansen Data.

Pancakeswap, the main decentralized network of the network, played a key role with $ 2.7 billion in daily volume. Overall, BSC managed more than $ 104 billion in volume DEX in the last month, exceeding Solana and Ethereum, according to Defillama Data.

This growth helped BNB crossing volatility triggered by clashes between Israel and Iran, which temporarily led to bitcoin of less than $ 104,000.

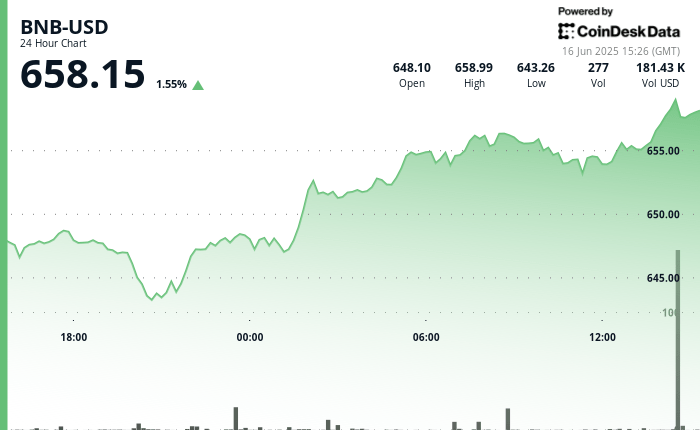

BNB has experienced a strong purchase interest throughout the day, held firm at $ 646 and exceeding $ 658. This force was supported by an unusually high volume and which seemed to be an institutional interest.

Technically, BNB benefits from a higher series of stockings, a sign of an upward trend of the building, according to the Technical Analysis Data model of Coindesk Research. Analysts also underlined coherent volumes above the average, suggesting more than the enthusiasm of retail.

The interest opened in BNB derivatives fell 6.9% from a week to $ 750 million, which is caution among merchants. However, the index of fear and broader greater greater is a neutral 51, which suggests that the feeling has not tipped the decline despite geopolitical tremors.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.