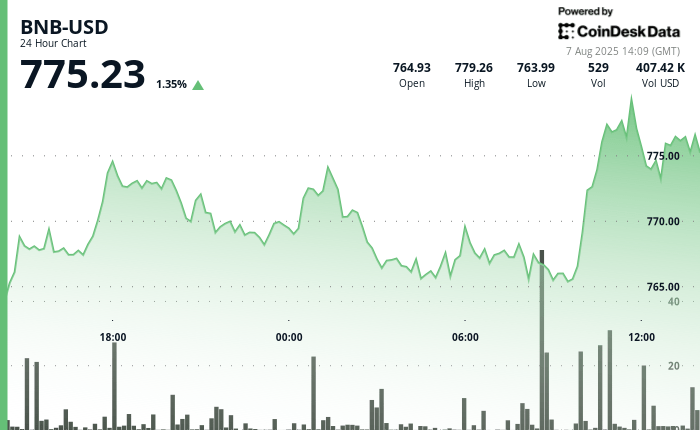

The BNB hovered nearly $ 780 after a net rally earlier in the day gave way to sales pressure.

The cryptocurrency increased by around 1.3% during the last 24-hour period, with a small withdrawal in the last hours. The token now oscillates around $ 776.

Earlier in the session, an increase in the volume of negotiation pushed BNB to a local summit of $ 778, testing resistance levels that have not been raped in recent weeks. This decision was short -lived.

A quick sale followed, reducing the lower price and the cutting gains made during the advance, according to the Technical Analysis model of Coindesk Research.

This decision comes in the midst of an enterprise adoption wave which recently saw the CEA Industries close a private investment of $ 500 million to continue its BNB cash strategy.

The wider context remains volatile. Investors are sailing in an environment shaped by the change in commercial policy and geopolitical risk, with the impact of Trump’s reciprocal rates which should come into force during the third quarter of the year.

In this context, the relatively stable performance of BNB is distinguished as a continuous demand signal, even if short -term volatility remains. Cryptoque data show that in the exchange tokens, BNB is a remarkable performance, down 8.7% compared to its top of all time, compared to 35% to 60% for most other tokens.

Preview of technical analysis

The most aggressive price movement occurred during a midday rally which sent the token up to $ 774.94. The volume exceeded 60,000 tokens during this movement, a signal that the largest participants can have conducted the action.

This gathering encountered resistance just below $ 780, where the sellers intervened and interrupted the advance.

The action of prices at this level has historically triggered inversions, and this session was no exception. A withdrawal followed, the price ended up slipping. While the drop has erased part of the gains of the day, BNB found constant support near this level.

The repeated defense of the zone from 765 to $ 766 suggests that buyers accumulate this range. Institutional interests often appear in this type of support in layers, where the price is held despite increased volume and sales pressure.

The total negotiation range for the session took place $ 16.83, or around 2.18%. Although it is not extreme, this volatility highlights the speed with which feeling can return.