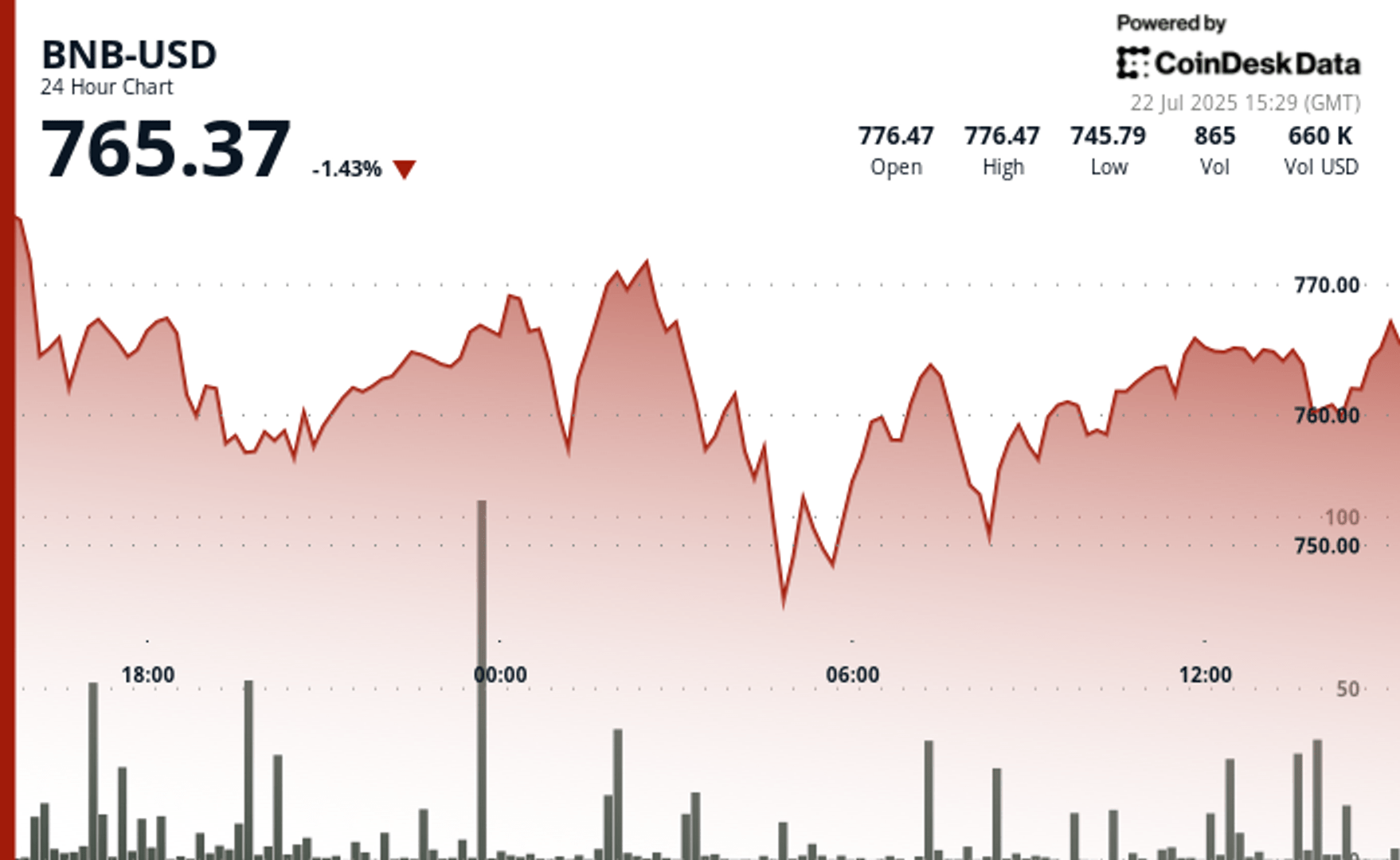

The price of BNB dropped by almost 1.5% volatile negotiation in the last 24 -hour period to recently negotiate around $ 765. It is down compared to a summit of almost $ 780 earlier this week.

The move dug a range of $ 34.87 in a short window, because the institutional sale hit the market and the buyers rushed to defend key support. The negotiation volume increased to almost 12,000 tokens in a single hour, pointing to a liquidation wave near the psychological level of $ 760, according to the Technical Analysis model of Coindesk Research.

The slow performance of the token has seen Solana Sol (soil) exceeding the BNB market capitalization after having increased by 3.5% in the last 24 hours. Sol now has a market capitalization of $ 109.3 billion, compared to $ 106.6 billion BNB.

Traders who look at the resistance area of $ 770 are rejection candles at the start of today’s negotiation session, often a sign of major players in the post unloading market. In response, Bulls organized a defense at $ 745.75, which led to a short -term recovery.

In the news related to BNB, Binance announced a temporary break in the withdrawals of the smart channel BNB on July 23 for the maintenance of the portfolio, which should last half an hour. Meanwhile, the blockchain infrastructure company Nano Labs said it had increased its BNB assets to 120,000 tokens, worth around $ 90 million.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.