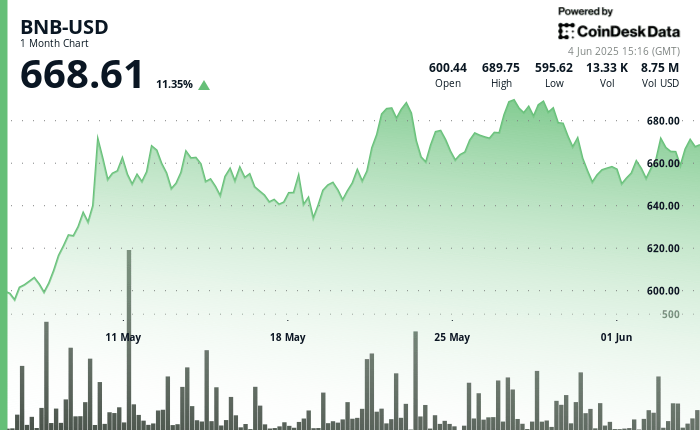

BNB has around $ 668, because positive developments in its ecosystem meet with regulatory tension and broader volatility on the market.

The token earned more than 11% in the last month, helped by a strong decentralized financial activity and the end of the long -term trial of the Securities and Exchange Commission against Binance.

Binance’s repression against bots exploiting its alpha points award system highlighted orders from the stock market, which probably increases investors’ confidence. Users were on automation to act on points to guarantee additional rewards.

Alpha Points has helped stimulate a wave of new activities from the BNB channel, which reports decentralized exchange rate volumes (DEX) up to $ 187 billion in May, giving the network a market share of 36% according to Dune Analytics.

An increasing automated activity threatened to erode confidence in the equity of the system.

At the same time, Pancakeswap, the flagship scholarship of the BNB chain, pulled $ 6.72 million in the past 24 hours, according to Defillama. The figure puts it above the circle of $ 6.35 million, the transmitter of the second largest USDC Stablecoin which envisages an IPO of an assessment of $ 7.2 billion, caused the same period.

The BNB chain itself recorded an increase in activity in May, dealing with 198 million transactions, up 148% compared to the previous month and exceeding Ethereum of transferred value, according to Dune data.

The action of BNB prices has remained technical, the support forming around $ 663 and resistance almost $ 691, according to the CoindSk Research technical analysis data model.

A break could push prices to $ 790, although any drop below $ 648 risks a correction, shows the model.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.