The Bnance BNB token climbed on Tuesday at the rear of the American securities commission and the exchange rejecting its longtime trial for the Crypto Exchange last week.

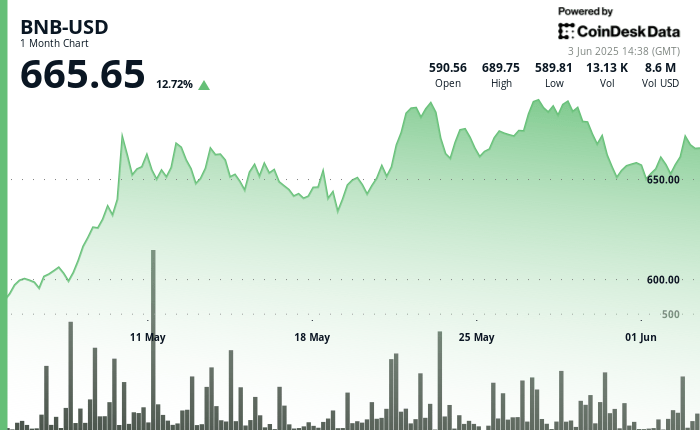

The token dropped from $ 650.28 to $ 673.70, an increase of 3.6%, before entering a lateral negotiation period and a short correction which returned to $ 665.

The SEC decision comes at a time when the exchange has brought back the previously limited American deposit characteristics, including ACH bank transfers, marking a partial restoration of the Binance FIAT channels on its American platform.

The calendar added fuel to the BNB rally, which came to a broader global financial discomfort, in particular the change in commercial policy and the increase in macroeconomic uncertainty.

Meanwhile, chain data showed that the BNB chain giving $ 14 billion in daily volume of decentralized exchange (DEX), exceeding Ethereum and Solana combined. This activity scale suggests that the BNB chain remains a crucial place for cryptographic trading despite the regulatory examination.

Preview of technical analysis

- On the technical side, BNB has shown strong accumulation models, according to the CoindSk Research technical analysis data model.

- The price action has formed an ascending channel, briefly culminating nearly $ 673.70 before retreating to consolidate above the level of $ 665 of psychological importance.

- A sharp volume increases around 01:00 and a renewal of purchases nearly $ 665.32 helped stabilize the price of the token, indicating the interest of buyers at these levels.

- If support continues to hold, traders can interpret the decision as the start of a longer upward trend, especially now that overhanging regulation has been lifted.