Global economic uncertainties reshape the markets of cryptocurrencies, because the BNB demonstrates an exceptional force in a context of increasing trade tensions. The impressive performance of the token occurs while institutional investors seem to accumulate positions, as evidenced by the volume of negotiation which doubles $ 1.08 billion.

Meanwhile, the ecosystem of the BNB chain continues to expand its usefulness thanks to the integration of AI and reduced gas costs, positioning it favorably against competitors like Solana and Ethereum.

Strengths of technical analysis

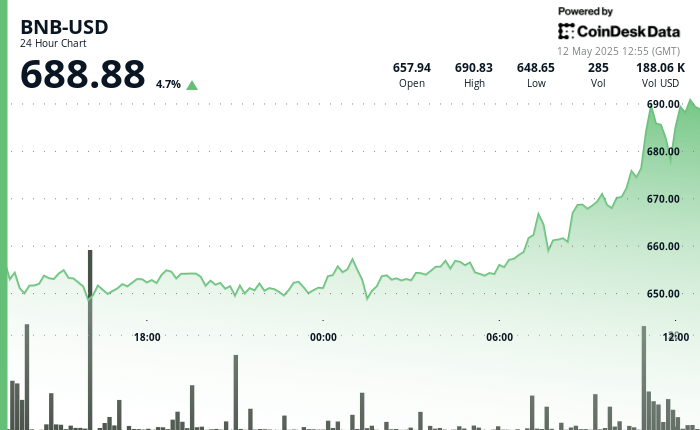

- BNB formed a clear ascending channel with a strong volume medium at the level of $ 657 to $ 658, where the purchase of the pressure has accelerated considerably, according to the Technical Analysis Data model of Coindesk Research.

- The volume increased to 151,956 BNB in 07:00, almost 4x the average of 24 hours, indicating significant accumulation.

- Three consecutive hours at high volume between 07: 00-11: 00 culminated with the strongest volume of 251 202 BNB in the last hour.

- A head and shoulder pattern formed in the last hour with the right shoulder completing around 11: 34-11: 36, before breaking under the plump support at $ 684.

- The heavy trading volume during periods of 11:04, 11:15 and 11:21 suggests an institutional positioning before reversal.

- The closing price of $ 678.07 represents a decrease of 1.7% compared to the top of the hour, with an increasing sale pressure in the last 10 minutes, the prices tested in terms of support of $ 677.

Warning: This article was generated with AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy. This article may include information from external sources, which is listed below if necessary.

External references