The BNB price has experienced net intra -day swings during the last 24 -hour period because it continued to go from a summit of $ 900 at the end of last month.

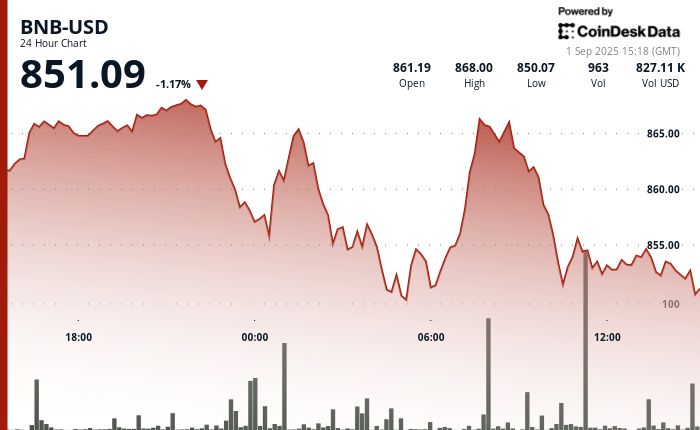

During a 24 -hour window, the asset exchanged between $ 849.88 and $ 868.76, a 2% decision that started with a bullish momentum but ended with signs of fatigue near the resistance.

Volatility follows documents with the Securities and Exchange American Commission by the Actions REX at the end of last month, as well as the rise of cash companies focused on the BNB. The latest strategy B aims to contain up to 1 billion dollars of BNB with the support of the investment company led by the co-founders of Binance Changpeng Zhao and Yi He.

While BNB failed to keep its earnings earlier, the activity of the underlying network jumped. The daily active portfolio addresses on the BNB channel have more than doubled, climbing nearly 2.5 million according to Defilma data.

However, transaction volumes have been going on regularly since the end of June, data from the same source show. BNB’s drop in prices were also before key economic data from the United States this week, including manufacturing and services and pay figures for August.

Job data could influence the chances that the federal reserve reduces interest rates this month. In the current state of things, the Fedwatch tool of the CME weighs a chance almost 90% of a reduction of 25 bps, while the Polymarket traders put the dimensions at 82%.

Preview of technical analysis

BNB entered the session with an overvoltage from $ 860.30 to $ 868.08, but the rally quickly lost steam. The high sale pressure emerged around the level of $ 867 to $ 868, an area which has now been imposed as a key resistance ceiling, according to the Technical Analysis model of Coindesk Research.

The volume jumped during this attempt, culminating at 72,000 tokens, well above the average of 54,000, indicating a high level of participation during the failure of the break.

After the rejection, BNB returned to the range from $ 850 to $ 855, where purchasing interests emerged. This was very visible because the token dropped $ 851.40, triggering a point of volume. This response highlighted a solid demand at these lower levels.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.