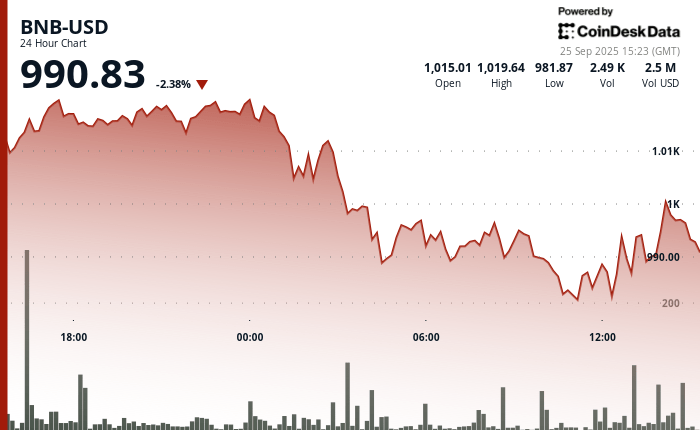

The BNB, the token that feeds the BNB chain and can be used for discounts on the costs of the main cryptocurrency exchange, has dropped by more than 2% in the last 24 hours in the middle of a larger cryptocurrency market.

The feeling in the industry remains poor, with the index for fear of crypto and greed now at 41 years old, a neutral level near fear, while the relative force index of average crypto (RSI), a technical indicator, indicates the surveillance levels according to CoinmarketCap.

The token went from $ 1,025 to just under $ 1,000 while sellers took control and resistance built almost $ 1,035, according to the Technical Analysis Data model for Coindesk Research. The larger CoindSk 20 (CD20) index fell 3.7%.

The BNB chain validators presented a proposal to reduce gas costs from 0.1 to 0.05 GWEI. The modification would drop the average transaction costs to around $ 0.005 and accelerate the blocking speeds of 750 milliseconds to 450 milliseconds.

The proposal comes at a time when chain trading activity is booming on the BNB channel after the launch of the decentralized trading platform Aster, which recently exceeded hyperliquid in daily perpetual trading volumes.

Preview of technical analysis

BNB exchanged in a range of $ 49 during the last 24 -hour period, falling at $ 993. Strong resistance was formed just above $ 1,030, while support maintained a company around $ 987.

The prize has been briefly recovered, at a little less than $ 990 to almost $ 994. The gain came when the purchase request appeared and pushed the token to form higher stockings.

The volume of negotiations suggested a passage from an aggressive sale to a slower accumulation, with support consolidating nearly $ 989 and resistance emerging just under $ 996.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.