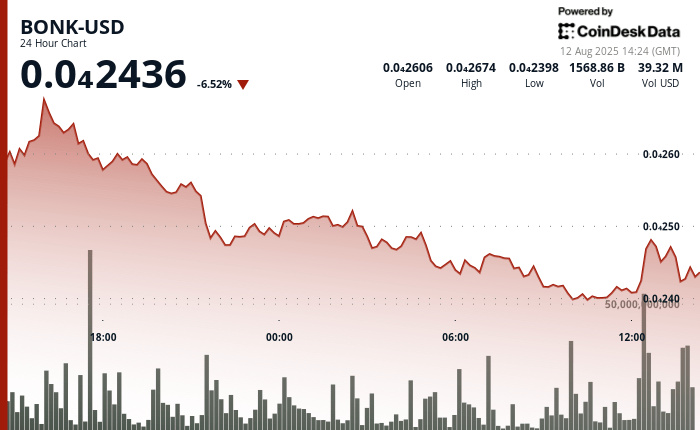

Bonk dropped almost 6% in the past 24 hours, from 0.00002606 to $ 0.00002436 in a decision that sculpted a range of $ 0.0000028, around 10% of its trading spectrum.

The decline accelerated after the token failed to maintain gains close to $ 0.0000,27 on August 11, where the volume increased to 1.13 billion of tokens, well above the average 24 hours a day, according to the CoindSk Research Technical Analysis Data.

The sale pressure persisted in the morning of August 12, with Bonk finding business support of about $ 0.000024 at 10:00 am on 889 billion negotiated tokens.

Bonk saw a rebound at the start of us in the morning, when buyers intervened and increased the price from 3% to $ 0.000025.

The rebound reported a possible short -term stabilization after prolonged withdrawal, forming $ 0.000024 as a key support to avoid more decline.

Volatility occurs the day after the day after the coup de security listed at the NASDAQ revealed a corporate cash purchase of 25 million dollars linked to the development of the Bonk ecosystem thanks to its participation in the Bonk.Fun Launchpad – a move considered by certain analysts as a sign more and more general exposure for the same parts sector.

Technical analysis

- P.

- Resistance: multiple refusals close to $ 0.000027 on August 11 with a high volume.

- Support: A solid base nearly $ 0.000024 on August 12 with 889b of chips exchanged.

- Pice of volume: 145B tokens during the breakdown of the consolidation at 12:30 p.m. UTC.

- Recovery displacement: gain of 3% from $ 0.000024 to $ 0.000025 between 11: 49–12: 48 UTC.

- Evasion trigger: Price cleared a resistance from $ 0.000025 to 12:22 UTC.

- Context of the market: Bounce follows several days of increased volatility in the same.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.