Bitcoin

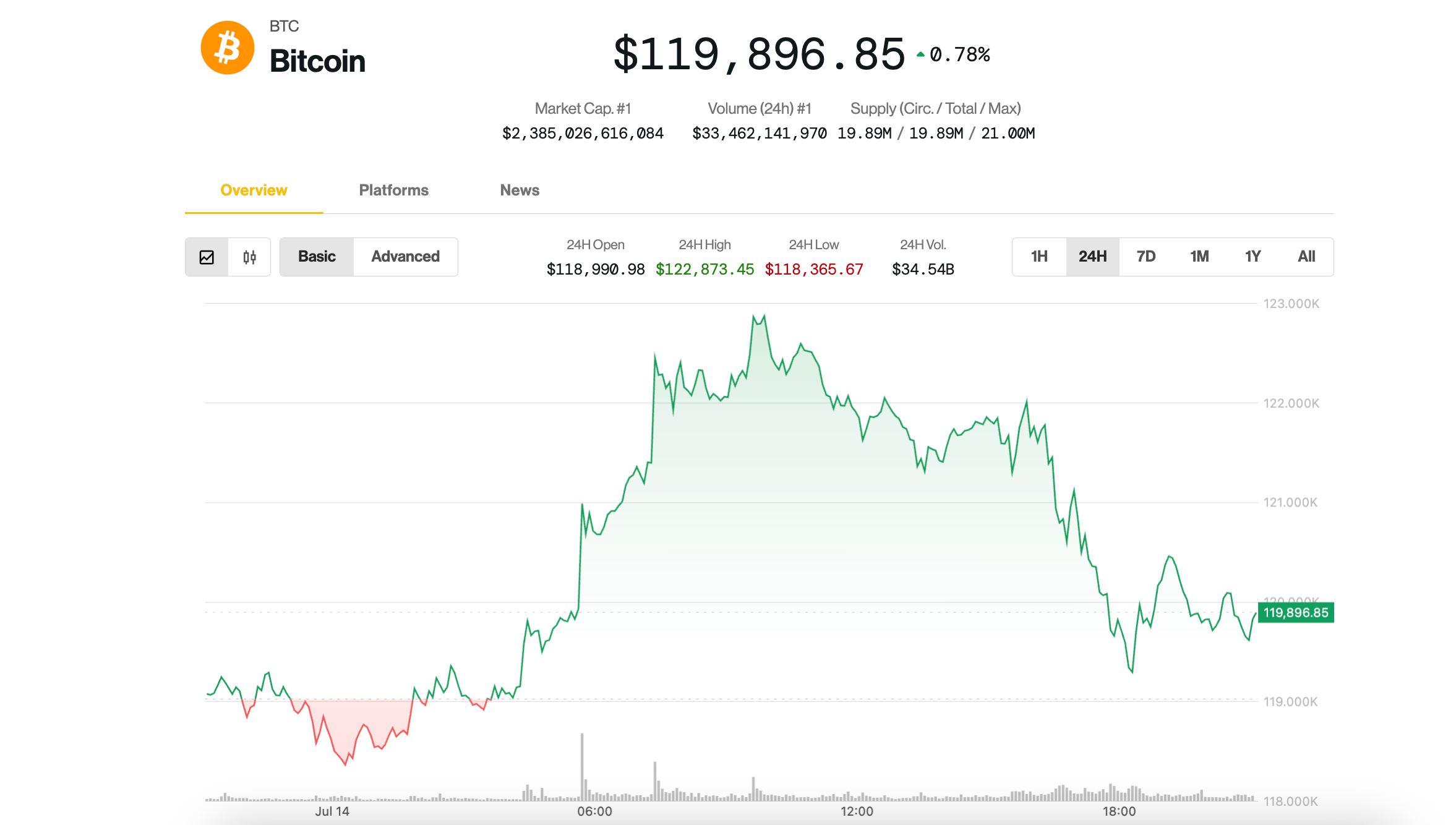

Refroved during US negotiation hours on Monday after exceeding almost $ 123,000 earlier in the session, but the best market calls are premature, analysts said.

BTC slipped below $ 120,000 at the end of American day, losing most of its advance of the day after, but retaining a modest gain of 0.6% in the last 24 hours. Etherum ether Ethn Slipped below $ 3,000, while Dogecoin

Ada de Cardano ADA And XLM of Stellar XLM decreased by around 2% to 3% during the day.

Among the majors, XRP

Sun and Uniswap Uni UNITED outperformed with gains of 2.5%, 10%and 6%, respectively.

Crypto-rhythm actions have also retraced some of their morning earnings, with a strategy (MSTR) and galaxy (GLXY) even higher by 3% -4%, while Coinbase (COIN) won 1.5%

After the BTC jumped more than 10% in less than a week and some Altcoins are growing much more, prices can consolidate while some traders digest the move and make profits.

However, this crypto rally stage is more likely in the first phases than towards the end, said Jeff Dorman, CIO of the ARCA digital asset investment company.

In an investor note on Monday, he cited the observation of the Crypto Will Clemente analyst on the main previous peaks such as the peak linked to the Bitcoin Spot of March 2024 and the frenzy of December 2024 / January 2025 surrounding the elections / inauguration of Trump, when the opening of the Altcoin derivatives returned that of the BTC de la BTC

“The current rally is far from that,” said Dorman.

Volumes on centralized and decentralized exchanges increased by 23% over the week, but are still not close to the levels during other wide market gatherings in the past, Dorman added.

Looking at the situation as a whole, Bitcoin is propelled by an excessive sovereign debt and investors who seek refuge against monetary inflation, said Eric Demuth, CEO of Crypto Exchange, based in Europe, Bitpanda.

He said the BTC increased to € 200,000 ($ 233,000)is “certainly a possibility”, but the underlying adoption of the asset is more important than the price objectives.

“What happens when bitcoin is permanently integrated into the portfolios of the main investors, in reserves of sovereign states and in the world’s banks infrastructure?”, He said. “Because that’s exactly what’s going on right now.”

In the coming years, Dermuth expects Bitcoin market capitalization to gradually converge to Gold, which is currently at more than 22 dollars, nine times larger than the BTC.