DOGE is outperforming broader crypto markets as volume climbs nearly 10% above weekly averages, signaling early accumulation within the breakout structure.

News context

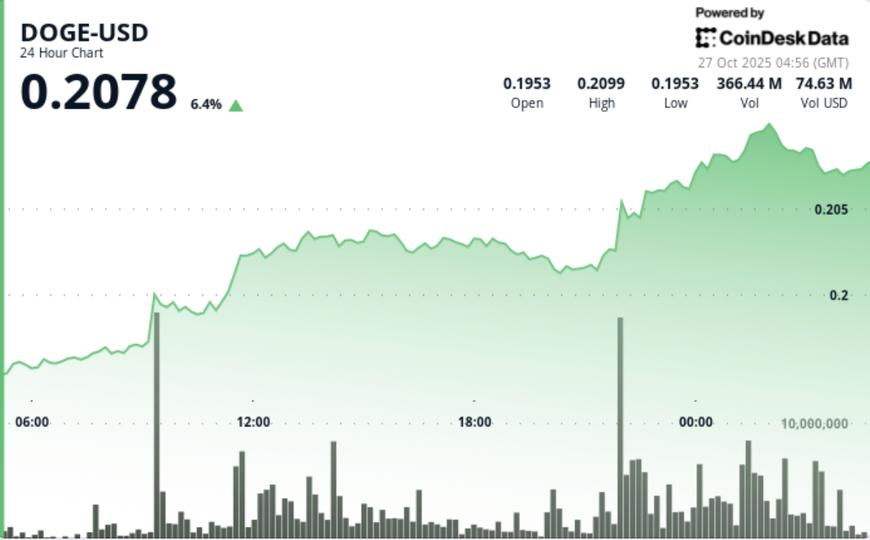

Dogecoin advanced 1.4% to $0.21 during Tuesday’s session, marking its first decisive move above the $0.2026 resistance threshold since late August. The meme coin’s price action demonstrated relative strength compared to the broader market, outperforming the CD5 Index by over 2%. Trading volumes jumped 9.82% above the seven-day average, reflecting sustained institutional participation in the meme assets segment.

Market analysts said the breakout represents “early cycle momentum” after nearly two months of compression in the $0.19-$0.20 corridor. “The resilience of DOGE during the consolidation of Bitcoin and Ethereum suggests that rotation flows are returning to higher beta assets,” said Rishi Patel, quantitative strategist at Bluepool Digital.

Price Action Summary

DOGE climbed steadily from $0.1950 to $0.2072 over a 24-hour window, establishing a streak of higher highs and higher lows over an intraday range of $0.0159. The key breakout occurred at 22:00 UTC, when volume reached 834.5 million tokens-roughly 180% above the 24-hour moving average and the price climbed beyond the pivotal resistance level of $0.2026.

The momentum continued early Wednesday, with DOGE briefly touching $0.2087 before encountering slight profit-taking. The retracement held comfortably above the $0.2070 support, confirming that former resistance has become an area of near-term demand.

Technical analysis

The technical system remains constructive. DOGE maintains an ascending trendline from the $0.1949 base, with successful retests of the $0.2060 to $0.2070 area highlighting continued buyer control. RSI readings are hovering around 58 on the 4-hour chart, consistent with the early stages of an uptrend, while the MACD remains positive but narrowing, reflecting short-term consolidation after the breakout breaks out.

Volume analysis shows a healthy distribution pattern rather than capitulation, implying reaccumulation rather than depletion. The price structure remains aligned with a bullish continuation phase, although confirmation of momentum requires a sustained close above $0.2085.

What Traders Should Know

- DOGE’s breakout above $0.2026 confirms a technical shift out of its multi-month consolidation range. Institutional flows continue to support price stability even if retail participation remains moderate.

- A successful defense of support at $0.2060 to $0.2070 could pave the way for a measured advance toward $0.2130 – the 38.2% Fibonacci retracement level of the May-September decline.

- However, failure to maintain current support risks causing a short-term pullback towards $0.1990. Traders are watching for further volume surges above the 800 million mark, confirming that smart money accumulation is still in play.